List Of Documents Tax Tribunal

What is List of documents tax tribunal?

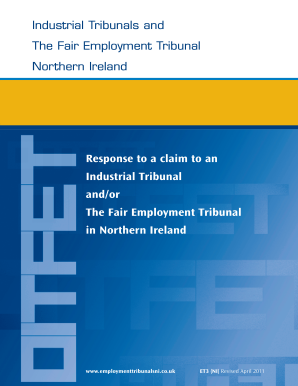

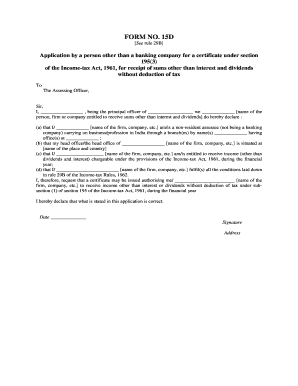

The List of documents tax tribunal is a crucial part of the legal process where all necessary documents relevant to a tax dispute are compiled and prepared for submission to the tax tribunal. These documents are essential for presenting a strong case and ensuring that all necessary information is available to the tribunal.

What are the types of List of documents tax tribunal?

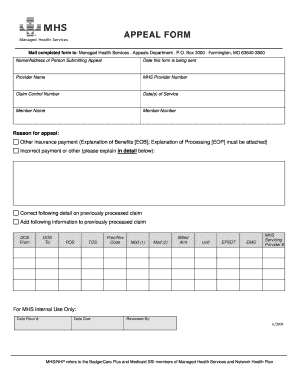

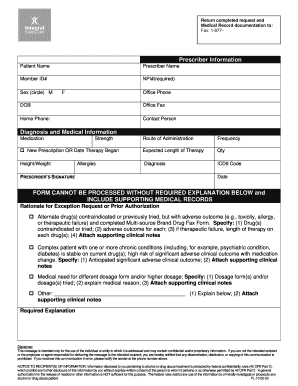

The types of documents included in the List of documents tax tribunal may vary depending on the specific case and applicable laws. However, common types of documents that are often included are tax forms, financial statements, correspondence with tax authorities, and supporting evidence or documentation.

How to complete List of documents tax tribunal

Completing the List of documents tax tribunal requires careful organization and attention to detail. Here are some steps to help you effectively prepare your documents:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.