Mp Expenses 2020

What is Mp expenses 2020?

MP expenses 2020 refer to the financial records of Members of Parliament for the year 2020. These expenses typically include costs related to office supplies, travel, accommodations, and other official duties.

What are the types of Mp expenses 2020?

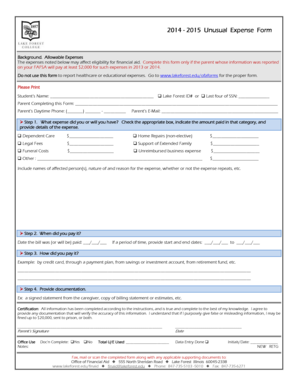

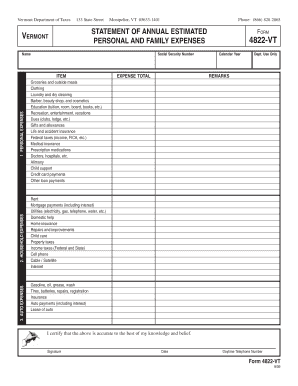

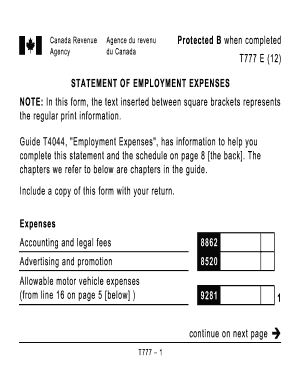

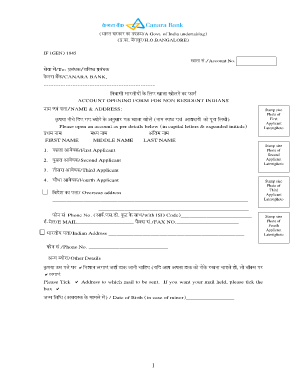

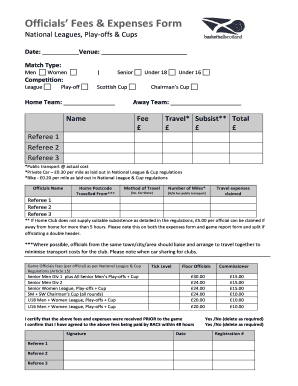

The types of MP expenses for 2020 can be categorized into various categories including:

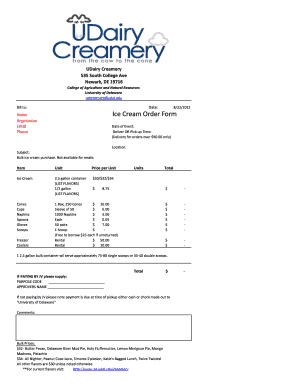

Office supplies and equipment expenses

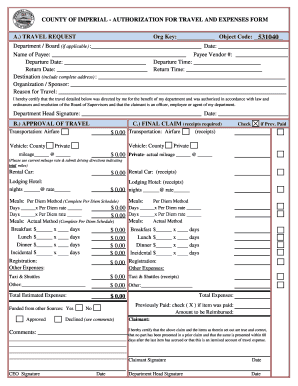

Travel expenses for official business

Accommodation expenses for parliamentary duties

Communication expenses such as phone and internet bills

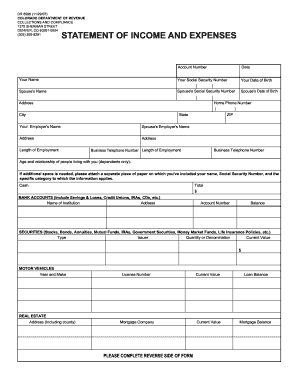

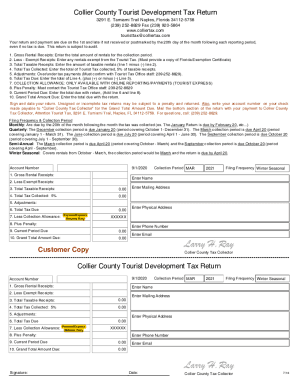

How to complete Mp expenses 2020?

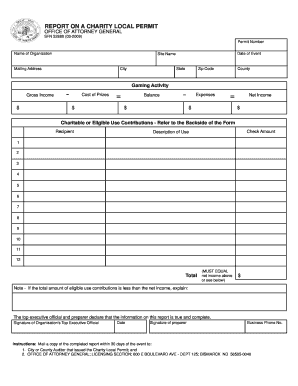

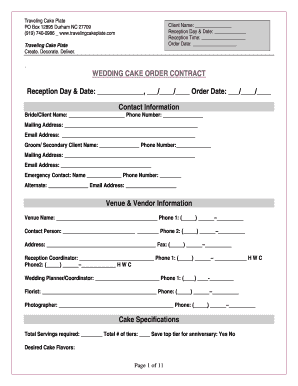

Completing MP expenses for 2020 can be done efficiently by following these steps:

01

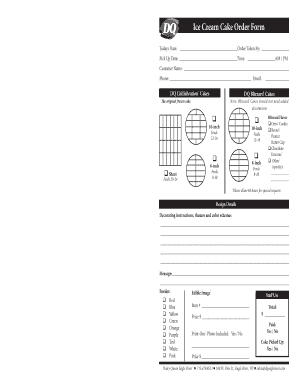

Gather all relevant receipts and documentation for expenses incurred during the year.

02

Organize the expenses into the appropriate categories outlined by the parliamentary guidelines.

03

Fill out the expense form provided by the parliamentary office accurately and truthfully.

04

Submit the completed expense report to the designated office for review and approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Mp expenses 2020

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How much does a local MP make a year?

Member of parliament earnings Pay for members of parliament depends on their level of responsibility. Members of parliament usually earn between $160,000 and $180,000 a year. Ministers can earn between $250,000 and $300,000.

How many MPs are there in the UK?

Like the upper house, the House of Lords, it meets in the Palace of Westminster in London, England. The House of Commons is an elected body consisting of 650 members known as members of Parliament (MPs).

When was the Tory expenses scandal?

The United Kingdom parliamentary expenses scandal was a major political scandal that emerged in 2009, concerning expenses claims made by members of the British Parliament in both the House of Commons and the House of Lords over the previous years.

How much is an MP paid in UK?

The basic annual salary of a Member Of Parliament (MP) in the House of Commons is £86,584, as of April 2023. In addition, MPs are able to claim allowances to cover the costs of running an office and employing staff, and maintaining a constituency residence or a residence in London.

What is the remuneration of MP?

India paid ₹176 crore (equivalent to ₹264 crore or US$33 million in 2023) to its 543 Lok Sabha members in salaries and expenses over 2015, or just over ₹2.7 lakh (equivalent to ₹4.1 lakh or US$5,100 in 2023) per month per member of parliament in including pensions to dependents of ex MPs .

Do MPs pay tax UK?

All MPs have to complete a Self Assessment tax return. Most employees do not need to use Self Assessment to complete tax returns. This is because Pay As You Earn (PAYE) and other tax-deduction systems collect the tax which is due or give the right allowances and reliefs.