Social Security Child Benefits Questions - Page 2

What is Social Security child benefits questions?

When it comes to Social Security child benefits, many parents have questions regarding eligibility, application process, and benefits available for their children. These questions often revolve around how to apply, who is eligible, and what documents are needed.

What are the types of Social Security child benefits questions?

The types of Social Security child benefits questions can vary but generally include inquiries about survivor benefits, dependent benefits, eligibility requirements, and how benefits are calculated. Some common questions may be related to the difference between survivor benefits and dependent benefits, age limits for receiving benefits, and what happens if a child becomes emancipated.

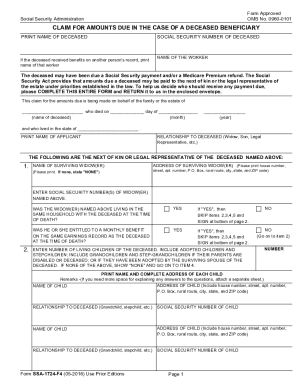

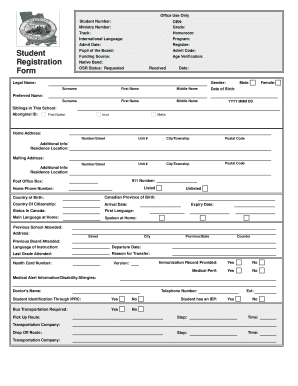

How to complete Social Security child benefits questions

Completing Social Security child benefits questions is a straightforward process that involves gathering necessary documents, filling out the required forms accurately, and submitting the application to the Social Security Administration. Here are some steps to help you complete Social Security child benefits questions:

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.