Credit Dispute Form Pdf

What is Credit dispute form pdf?

A Credit dispute form PDF is a digital document that allows individuals to challenge inaccuracies or incomplete information on their credit report.

What are the types of Credit dispute form pdf?

There are different types of Credit dispute form PDFs, including:

Initial Dispute Form: Used to start the dispute process

Follow-up Dispute Form: Additional information requested by credit bureaus

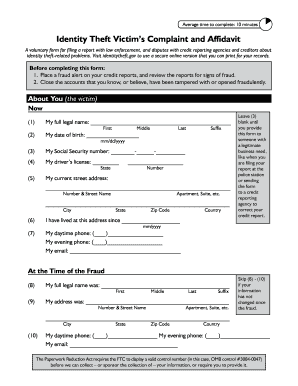

Identity Theft Affidavit: Used in cases of identity theft

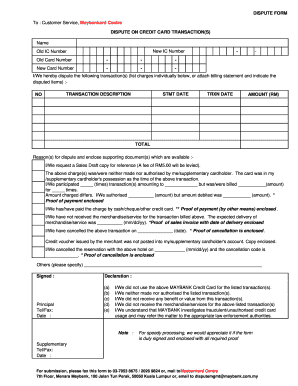

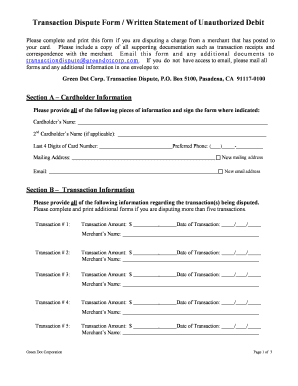

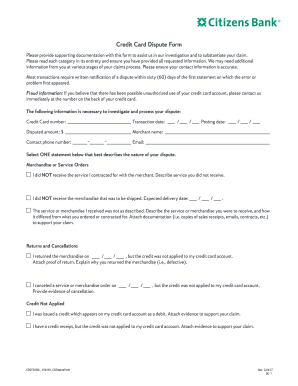

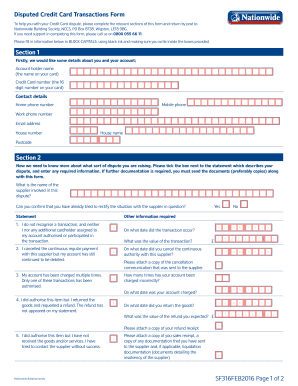

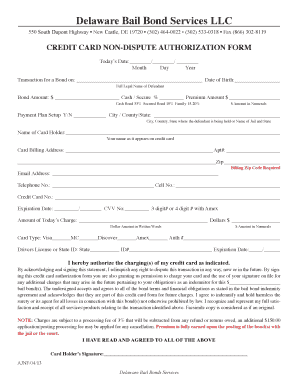

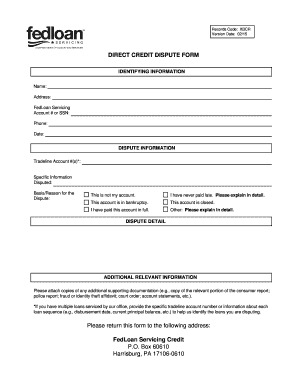

How to complete Credit dispute form pdf

Completing a Credit dispute form PDF is a simple process that involves the following steps:

01

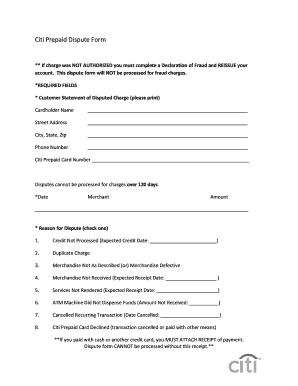

Fill in your personal information accurately

02

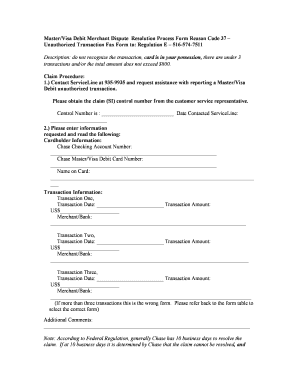

Clearly state the inaccuracies or incomplete information on your credit report

03

Provide any supporting documentation if necessary

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Credit dispute form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Does 609 credit repair really work?

If disputes are successful, the credit bureaus may remove the negative item. Any accurate or verifiable information will stay on your credit report—a 609 letter doesn't guarantee its removal. However, you may increase your chances of removal if you follow a 609 letter template and provide enough information.

What is a 609 dispute letter PDF?

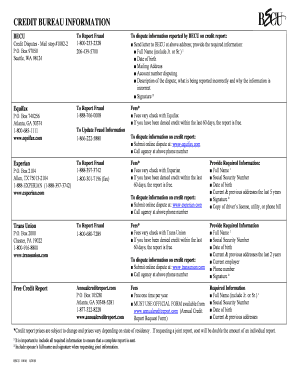

A 609 letter template is a form letter that is used to dispute items on a credit report. The letter is sent to the credit reporting agency, and the purpose is to request that the disputed information be removed.

What is a 609 letter to remove debt from credit report?

If you want to repair your credit, a 609 dispute letter could solve your problems. This is a letter any consumer may send to the three credit bureaus requesting additional information after finding an inaccuracy on your credit report. It usually includes a request to remove the inaccuracies from the credit report.

What is Form 609 for credit?

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices. Written by Natasha Wiebusch, J.D..

Can I write my own dispute letter?

You may dispute information on your credit report by submitting a dispute form, or write your own letter that details your issues.

How do I fill out a credit dispute form?

Information to include in your dispute letter Full name. Date of birth. Current address. Driver's license number. Social Security number (optional). The account number of the tradeline you're disputing (e.g., account number found on your utility bill, student loan bill or mortgage statement).