Bank Credit Dispute Form Templates

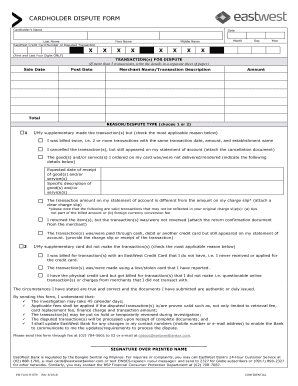

What are Bank Credit Dispute Form Templates?

Bank Credit Dispute Form Templates are standardized forms that individuals can use to dispute any errors or discrepancies on their credit reports related to their banking transactions. These forms provide a structured way for users to communicate their concerns and seek resolution.

What are the types of Bank Credit Dispute Form Templates?

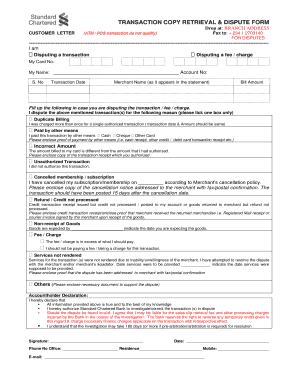

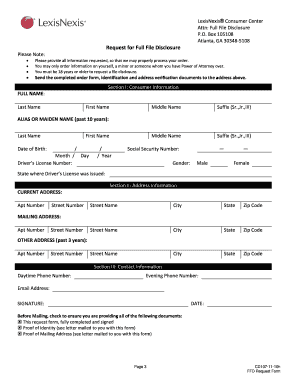

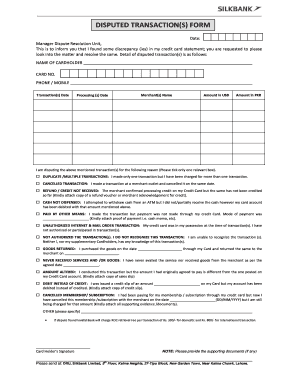

There are various types of Bank Credit Dispute Form Templates tailored to different types of banking disputes. Some common types include:

Duplicate transaction dispute form

Credit report error dispute form

Identity theft dispute form

Fraudulent activity dispute form

How to complete Bank Credit Dispute Form Templates

Completing a Bank Credit Dispute Form Template is a straightforward process that involves the following steps:

01

Fill in your personal information accurately

02

Specify the disputed transaction details clearly

03

Provide any supporting documentation if available

04

Submit the completed form to your bank or credit reporting agency

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Bank Credit Dispute Form Templates

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a dispute form?

Your letter should identify each item you dispute, state the facts, explain why you dispute the information, and ask that the business that supplied the information take action to have it removed or corrected. You may want to enclose a copy of your report with the item(s) in question circled.

Is a 609 dispute letter effective?

If disputes are successful, the credit bureaus may remove the negative item. Any accurate or verifiable information will stay on your credit report—a 609 letter doesn't guarantee its removal. However, you may increase your chances of removal if you follow a 609 letter template and provide enough information.

How do you write a dispute letter for a bank?

I want to inform you that the statement issued to me from bank includes an erroneous charge of Rs. 10,000, dated 20th February 2014. I have enclosed a copy of the statement with the false charge circled in red. This particular payment was cancelled on the same day since I had returned the purchase soon after.

What is a 623 dispute letter?

4) 623 credit dispute letter A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is a 609 dispute letter?

A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them. You'll find countless 609 letter templates online. however, they do not always promise that your dispute will be successful.

What is the 623 credit law?

Section 623 of the FCRA and Regulation V generally provide that a furnisher must not furnish inaccurate consumer information to a CRA, and that furnishers must investigate a consumer's dispute that the furnished information is inaccurate or incomplete.

Related templates