Sample Letter To Remove Items From Credit Report

What is Sample letter to remove items from credit report?

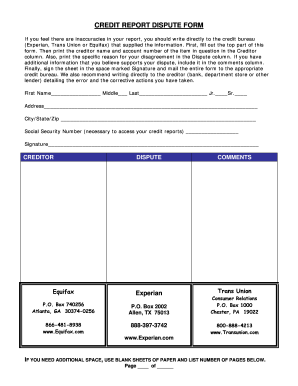

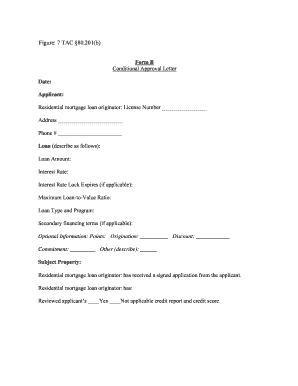

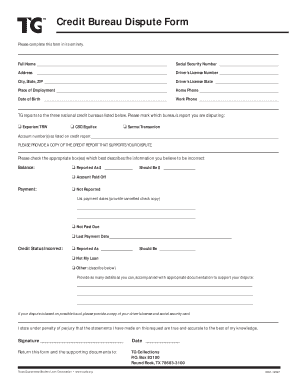

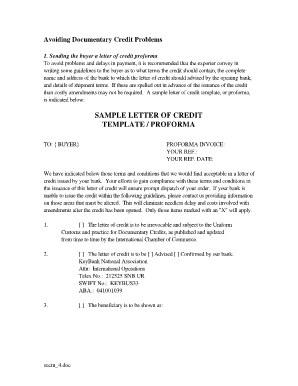

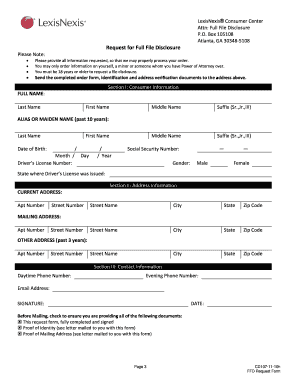

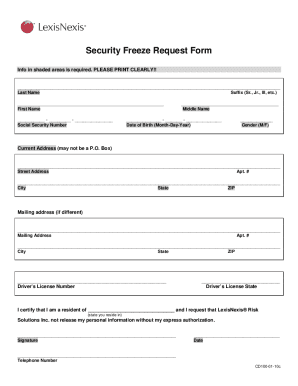

A Sample letter to remove items from credit report is a formal letter that individuals can use to dispute inaccuracies or errors on their credit report. By sending a letter to the credit bureaus requesting the removal of erroneous items, you can improve your credit score and financial standing.

What are the types of Sample letter to remove items from credit report?

There are several types of Sample letters to remove items from a credit report, including:

Basic dispute letter template

Debt validation letter template

Goodwill letter template

Pay-for-delete letter template

How to complete Sample letter to remove items from credit report

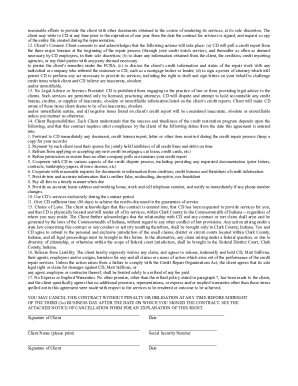

To complete a Sample letter to remove items from a credit report, follow these steps:

01

Start by addressing the letter to the specific credit bureau reporting the inaccuracies.

02

Clearly state the errors you are disputing and provide any supporting documentation.

03

Request the removal or correction of the disputed items.

04

Close the letter with your contact information and a request for confirmation of the changes made.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Sample letter to remove items from credit report

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a Section 604 dispute letter?

What is a 604 Dispute Letter? A 604 dispute letter is a great way to get inaccurate information off your credit report. Writing this type of letter can help you ensure that any negative items on your credit report are accurate, which in turn can have a substantial impact on your credit score.

What is the difference between a 609 and 604 dispute letter?

As a result, they're often confused. But they have different purposes, and only Section 609 will support a dispute letter. Under the FCRA, Section 604 defines the circumstances under which a consumer reporting agency may furnish a consumer report. This section is titled “Permissible purposes of consumer reports.”

What does a 609 letter do?

A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them. You'll find countless 609 letter templates online. however, they do not always promise that your dispute will be successful.

Is a 609 dispute letter effective?

If disputes are successful, the credit bureaus may remove the negative item. Any accurate or verifiable information will stay on your credit report—a 609 letter doesn't guarantee its removal. However, you may increase your chances of removal if you follow a 609 letter template and provide enough information.

What do I say to get something removed from my credit report?

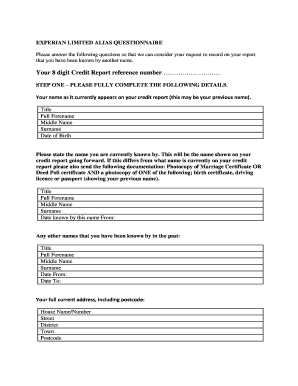

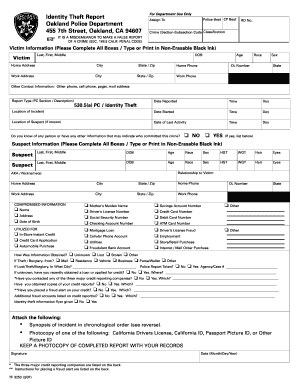

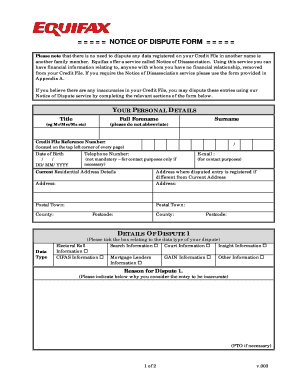

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.

What are the different types of credit dispute letters?

After writing a general dispute letter or a 609 credit disputing letter, followed by a 611 credit disputing letter, consumers can send a 623 credit disputing letter. With a 623 credit disputing letter, consumers request the credit agency to provide evidence to validate that the debt is theirs.