Home Loan Application Template - Page 2

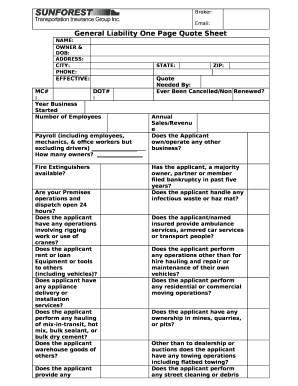

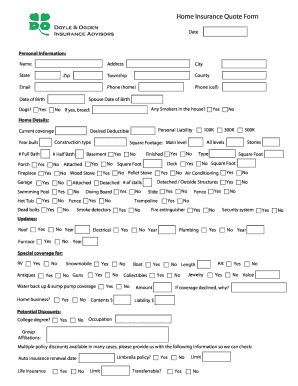

What is Home loan application template?

The Home loan application template is a standardized form used by financial institutions to collect personal and financial information from individuals applying for a home loan. It streamlines the application process by providing a structured format for gathering necessary details from applicants.

What are the types of Home loan application template?

There are several types of Home loan application templates available, each designed to cater to different types of borrowers and loan requirements. Some common types include:

How to complete Home loan application template

Completing a Home loan application template is a straightforward process that involves providing accurate and detailed information about your financial status and personal details. Here are some steps to help you complete the form effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.