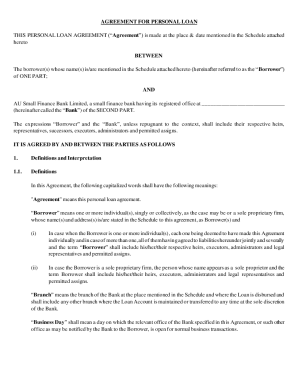

Personal Loan Agreement Pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I get out of a personal loan agreement?

Contact the lender to tell them you want to cancel - this is called 'giving notice'. It's best to do this in writing but your credit agreement will tell you who to contact and how. If you've received money already then you must pay it back - the lender must give you 30 days to do this.

Does a personal loan agreement need to be notarized?

While without notarization a loan agreement is valid, notarization makes it legally binding and enforceable.

How do I write a simple personal loan agreement?

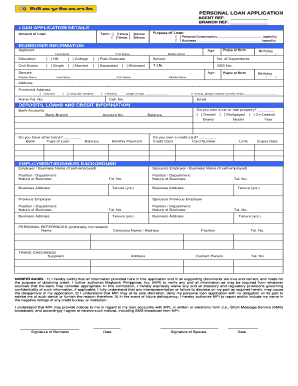

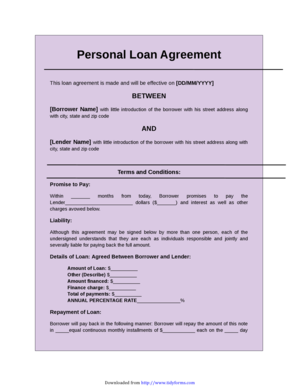

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

Are personal loan agreements legal?

The answer is yes! A personal loan agreement is legally binding once both parties have signed it. This means that both parties are obligated to fulfill their respective roles in the contract until its completion.

How do I make a loan contract legally binding?

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.

How do I write a legal contract for a loan?

The steps for writing a legally binding loan contract are: The effective date of the loan. What state's lending laws will apply (if lender and borrower are in different states). Full information on both the borrower and lender. Loan amount. Interest amount. Repayment. Late fees. Collateral (if applicable).