Loan Agreement Letter

What is a Loan agreement letter?

A Loan agreement letter is a legally binding document that outlines the terms and conditions of a loan between a lender and a borrower. It specifies the amount of the loan, interest rate, repayment schedule, and any other relevant details agreed upon by both parties.

What are the types of Loan agreement letter?

There are several types of Loan agreement letters, including:

Personal Loan agreement letter

Business Loan agreement letter

Mortgage Loan agreement letter

Student Loan agreement letter

Auto Loan agreement letter

How to complete Loan agreement letter

Completing a Loan agreement letter is a straightforward process. Here are the steps you can follow:

01

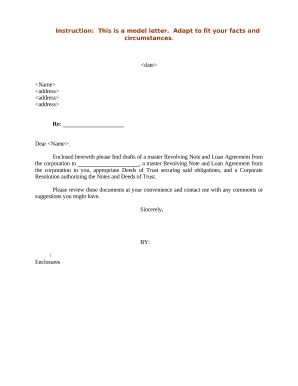

Start by downloading a Loan agreement letter template or using an online platform like pdfFiller.

02

Fill in the required information such as the names of the lender and borrower, loan amount, and repayment terms.

03

Review the document carefully to ensure all details are correct and complete.

04

Sign and date the Loan agreement letter to make it legally binding.

05

Share the document with the other party for their signature and keep a copy for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I write a letter of agreement for a loan?

The loan agreement letter format will follow that of any legal contract. The content must explain the financial obligations of both parties: what the lender will provide and how the borrower is expected to return the sum. The time period and details of payment should be included in this letter, as well.

How do I write a quick loan agreement?

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan cosigner, if applicable. Amount borrowed. Date the loan was provided. Expected repayment date. Interest rate, if applicable. Annual percentage rate (APR), if applicable.

How do I make a simple loan agreement?

To draft a Loan Agreement, you should include the following: The addresses and contact information of all parties involved. The conditions of use of the loan (what the money can be used for) Any repayment options. The payment schedule. The interest rates. The length of the term. Any collateral. The cancellation policy.

How do I make a loan agreement between friends?

Consider including: Names and addresses of the parties to the agreement. Loan amount (principal). Interest rate. Repayment terms, including dates, and any late fees or penalties. Signature lines.

How do I write a loan agreement between two parties?

What are the Contents of a Personal Loan Agreement Form? Complete details of both the borrower and the lender, i.e. their full names and complete addresses. The total amount of the loan, both in numbers and words. The interest rate for the loan amount, if applicable. The date when the loan agreement goes into effect.

Can I write my own loan agreement?

A loan agreement should accompany any loan of money. For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.