Loan Application Form Online - Page 2

What is Loan application form online?

A Loan application form online is a digital document that allows individuals to apply for a loan through an online platform. This convenient tool eliminates the need for paper applications and enables users to fill out the form electronically.

What are the types of Loan application form online?

There are several types of Loan application forms online, including:

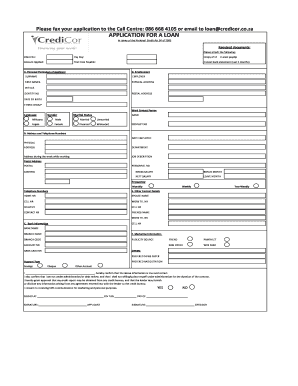

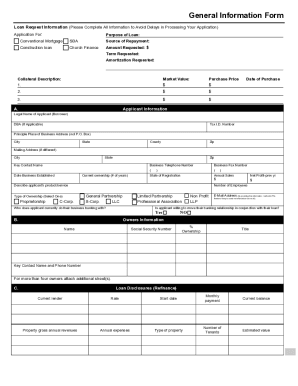

Personal Loan application form

Mortgage Loan application form

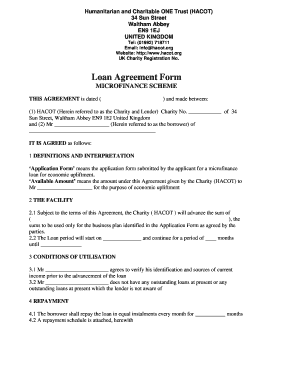

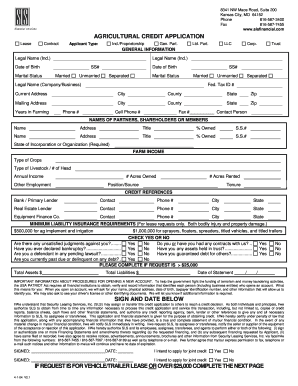

Business Loan application form

Auto Loan application form

How to complete Loan application form online

Completing a Loan application form online is simple and efficient. Here are some steps to guide you:

01

Access the online form on the lender's website.

02

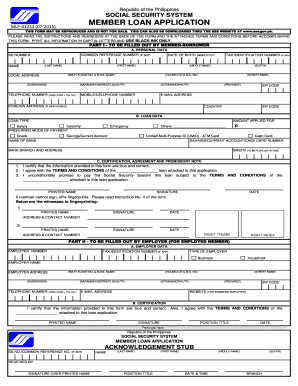

Fill in your personal information, including name, address, and contact details.

03

Provide details about the type of loan you are applying for and the amount.

04

Upload any required documents, such as identification or proof of income.

05

Review the form for accuracy and submit it electronically.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan application form online

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the easiest way to get approved for a loan?

Review your score: One of the most effective ways to improve your chances of approval is to work on polishing your credit profile and notching up your credit score. Focus on consistently making all of your debt payments on time and paying down outstanding debts. It's also a good idea to avoid taking on any new debt.

How to easily get approved for a loan?

Review your score: One of the most effective ways to improve your chances of approval is to work on polishing your credit profile and notching up your credit score. Focus on consistently making all of your debt payments on time and paying down outstanding debts. It's also a good idea to avoid taking on any new debt.

How can I increase my chances of getting a loan?

How To Improve Your Chances of Getting a Personal Loan Check the lender's eligibility criteria. Track your fixed-obligation-to-income ratio (FOIR) Apply for the right loan amount. Avoid applying for too many loans at the same time. Improve your credit score. Add your spouse or parents as co-borrowers.

Can you do a loan application online?

If you're comfortable with technology, then applying through an online portal may be your best option when it comes to finding the right loan for you. This is especially true if you need the funds quickly. Online lenders can disburse the money in as soon as one to two business days following approval.

How to write a loan application form?

Include the following information: Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

Who is the easiest to get a personal loan from?

Easiest personal loans to get Best for bad credit: Avant Personal Loans. Best for flexible terms: OneMain Financial Personal Loans. Best for no credit history: Upstart Personal Loans. Best for fast approval: LendingPoint Personal Loans. Best for small loan amounts: Oportun.