Covid-19 Loan Application Form

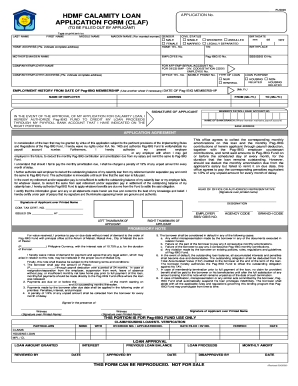

What is Covid-19 loan application form?

The Covid-19 loan application form is a document that individuals or businesses can use to apply for financial assistance offered in response to the economic impacts of the Covid-19 pandemic. This form allows applicants to provide necessary information and details to request funding or support to help mitigate the financial challenges caused by the crisis.

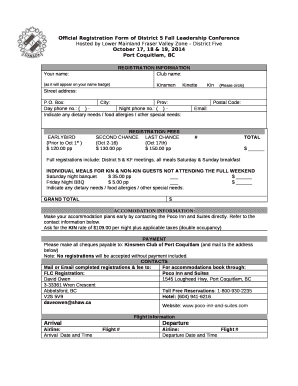

What are the types of Covid-19 loan application form?

There are several types of Covid-19 loan application forms available to cater to different needs and circumstances. Some common types include:

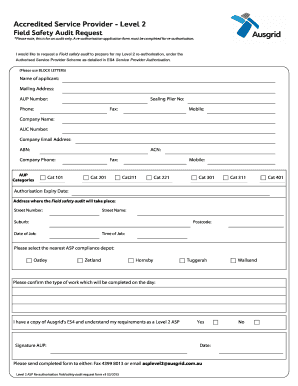

How to complete Covid-19 loan application form

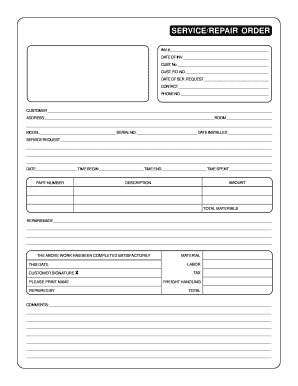

Completing the Covid-19 loan application form is a crucial step in seeking financial assistance during these challenging times. Here are some tips to help you successfully fill out the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.