Donation Agreement Template South Africa - Page 2

What is Donation agreement template south africa?

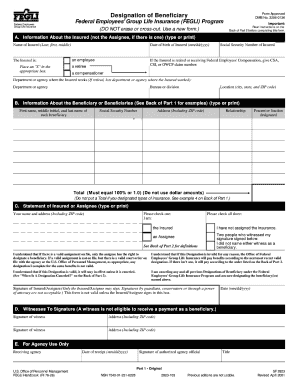

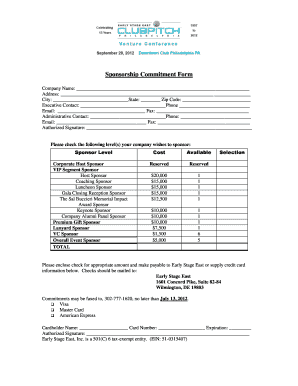

A Donation Agreement Template South Africa is a legal document that outlines the terms and conditions of a donation between a donor and a recipient in South Africa. This agreement ensures both parties understand their rights and responsibilities regarding the donation.

What are the types of Donation agreement template south africa?

There are several types of Donation Agreement Templates in South Africa, including: 1. Monetary Donation Agreement 2. In-Kind Donation Agreement 3. Conditional Donation Agreement 4. Unconditional Donation Agreement

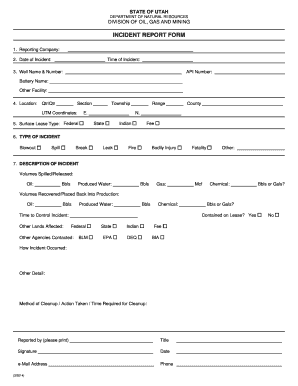

How to complete Donation agreement template south africa

Completing a Donation Agreement Template in South Africa is a straightforward process. Follow these steps: 1. Start by entering the donor and recipient's information. 2. Specify the details of the donation, including the amount or nature of the donation. 3. Outline any conditions or restrictions related to the donation. 4. Include signatures from both parties to make the agreement legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.