Arts And Crafts Fair Application

What is Arts and crafts fair application?

Arts and crafts fair application is a digital platform that allows artisans and craftsmen to apply to participate in various art and craft fairs. It provides a convenient way for artists to showcase their work and connect with potential customers.

What are the types of Arts and crafts fair application?

There are several types of Arts and crafts fair applications available, including:

Online applications through websites or mobile apps

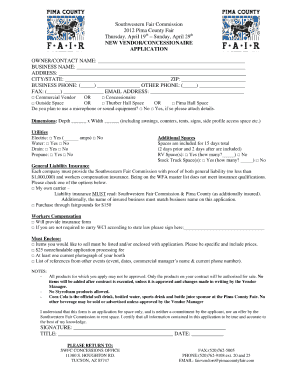

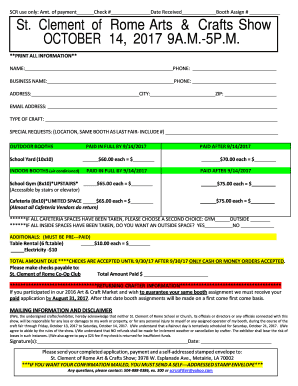

Paper applications submitted in person or by mail

Email submissions to event organizers

How to complete Arts and crafts fair application

Completing an Arts and crafts fair application is a straightforward process that can be broken down into the following steps:

01

Fill out personal information such as name, contact details, and artistic background

02

Upload images or samples of your work to showcase your talent

03

Provide a brief description of your art or craft and what sets it apart

04

Review and submit your application to the event organizers for consideration

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Arts and crafts fair application

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Do I need a Licence to sell at a craft fair?

When it comes to crafting, there are very few areas in which a licence is essential. If you are working with and selling alcohol, food or have a business premise that isn't your home, you may need a licence. Otherwise, it is mostly acceptable for a small business to simply register with HMRC and begin trading.

How do I become a local craft fair vendor?

At a juried craft fair, judges examine potential vendors' work to determine if they will be accepted into the fair. At a non-juried fair, vendors simply need to purchase their booth space.

Do you have to pay taxes if you sell crafts?

Craft items are taxable as goods. If you teach a class on making your craft, teaching is a service and wouldn't be taxable. Other states tax both goods and services, so you'll have to check with your state to be sure. Six states collect no sales tax at all -- Alaska, Montana, Hawaii, Oregon, Delaware and New Hampshire.

Do crafters need an EIN number?

Additionally, if you're going to hire some employees to help with your craft business, you will also have to obtain an employer identification number (EIN). An EIN is required for tax purposes, among other things.

Can I sell things I make as a hobby?

HINT: Talk to your CPA or tax preparer for more information. BUT, as soon as you open an Etsy, Facebook, Ravelry, etc. shop and expect others to pay a fair market value for your finished objects, the IRS then considers you to be a handmade business – because you then intend to make a profit on the items you sell.

Do I need a tax ID to sell my crafts?

In most cases, anyone selling goods or services at a craft fair must have a valid business license. The requirements for obtaining a business license vary from state to state, but businesses generally need to register with the state and obtain a tax ID number.