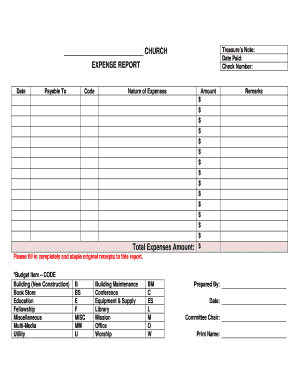

Simple Expense Reimbursement Form Pdf

What is Simple expense reimbursement form pdf?

A Simple expense reimbursement form pdf is a document used by organizations to reimburse employees for expenses incurred during work-related activities. This form typically includes fields for recording the date, description, and amount of each expense, as well as the required supporting documentation.

What are the types of Simple expense reimbursement form pdf?

There are several types of Simple expense reimbursement form pdf, including but not limited to:

Standard Expense Reimbursement Form

Mileage Reimbursement Form

Travel Expense Reimbursement Form

Per Diem Expense Reimbursement Form

How to complete Simple expense reimbursement form pdf

Completing a Simple expense reimbursement form pdf is a straightforward process that involves the following steps:

01

Fill in the employee's personal information, including name, employee ID, and department.

02

Enter the details of each expense, such as date, description, and amount.

03

Attach supporting documentation, such as receipts or invoices, to substantiate each expense.

04

Review the completed form for accuracy and completeness before submitting it for reimbursement.

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple expense reimbursement form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do I claim reimbursed expenses on my taxes?

Because reimbursements under the accountable plan are not wages and are not taxed, you do not have to report the amount. Do not include the amount with the employee's wages on Form W-2. Instead, report it in Form W-2 box 12 with code L.

What are the rules for reimbursement?

Federal Law on Employee Reimbursement Federal law states that an employer only needs to reimburse their employees for work-related expenses that drop their earnings below the minimum wage.

Can I claim expenses that I was reimbursed for?

Reimbursements received outside the rules of the accountable plan will be classified as taxable income and reported on the W-2. This means that the employee would deduct them on their personal tax return.

How do I write a reimbursement letter for expenses?

How to write this request letter: Give an explanation for requesting the refund or reimbursement. Request the refund or reimbursement. If you have enclosed receipts or other documents for reimbursement, tell the reader about them. Explain how or when you want to receive the refund or reimbursement and thank the reader.

What form is used for the reimbursement of expenses?

An expense claim form is the same as an expense reimbursement form - it is simply a form that documents business expenses that an employee must be reimbursed for.

How do I claim reimbursement of expenses?

The expense reimbursement claim process Expense reports. Expense reports are the first step in the expense reimbursement claim process. Approvals and Verifications. ing to some studies, most approvals only take about 5 minutes (per expense report). Expense reimbursement claim: settlement or rejection.