Car Finance Application Form Pdf

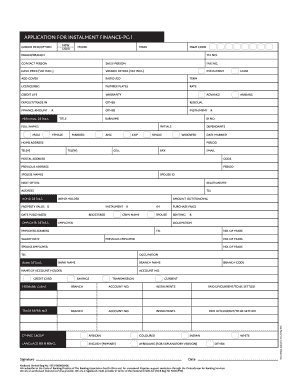

What is Car finance application form pdf?

A Car finance application form pdf is a document used by individuals looking to apply for financing to purchase a car. It typically includes personal information, financial details, and details about the desired vehicle.

What are the types of Car finance application form pdf?

There are several types of Car finance application form pdf, including:

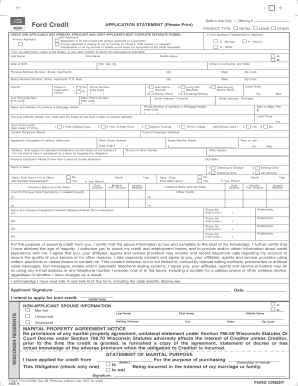

Individual car loan application form pdf

Joint car loan application form pdf

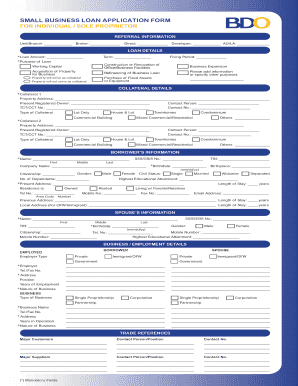

Business car loan application form pdf

Refinance car loan application form pdf

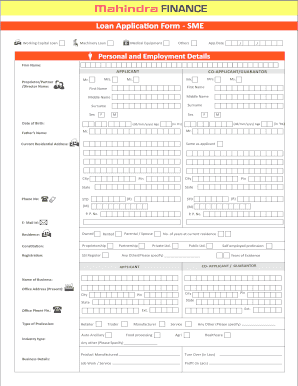

How to complete Car finance application form pdf

To successfully complete a Car finance application form pdf, follow these steps:

01

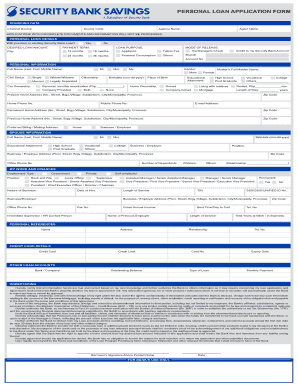

Fill in personal information accurately

02

Provide detailed financial information

03

Specify the type of loan desired

04

Include details about the car being purchased

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Car finance application form pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How long do you have to have a job to get a loan?

Job history requirements by mortgage loan type Loan TypeJob History RequirementConventionalTwo years of related history. Need to be at current job for six months if applicant has employment gapsFHA loanTwo years of related history. Need to be at current job for six months if applicant has employment gaps2 more rows • Apr 5, 2023

How to get a car loan with a job offer letter?

While job offer letters provide proof of employment and basic salary information, you probably won't be able to get a car loan with only a job offer letter. Most lenders require pay stubs with year-to-date income since your monthly take-home pay plays a major role in determining whether you qualify.

Will Carvana take an offer letter?

We will need your official employment offer letter along with your first pay stub in order to verify your income.

How many paychecks do I need for a car loan?

How Many Pay Stubs Do You Need for a Car? You need to provide at least two months' worth of pay stubs for each year you're applying for a car loan. Pay stubs must be from the same employer and pay period, as well as in the same currency and format.

How can I finance a car without pay stubs?

But do you need pay stubs for an auto loan? No — other options may be acceptable, including current bank statements, W-2s, and 1099s. If you're self-employed, your most recent two years of income tax returns can also help prove to a lender that you have the income to keep up with a car loan payment.

How do I start financing a car?

We'd suggest that you approach your car purchase by following the process outlined below. Step 1: Check Your Credit Score. Step 2: Apply for a Loan With Multiple Lenders. Step 3: Get Preapproved. Step 4: Find Your Car and Finalize Your Loan.