Car Loan Form Pdf - Page 2

What is Car loan form pdf?

A Car loan form pdf is a document that individuals fill out to apply for a loan to finance the purchase of a vehicle. It typically includes personal information, employment details, and details about the vehicle being purchased.

What are the types of Car loan form pdf?

There are several types of Car loan form pdf, including: 1. New Car Loan Application Form 2. Used Car Loan Application Form 3. Refinance Car Loan Application Form 4. Bad Credit Car Loan Application Form 5. Lease Buyout Loan Application Form 6. Military Car Loan Application Form

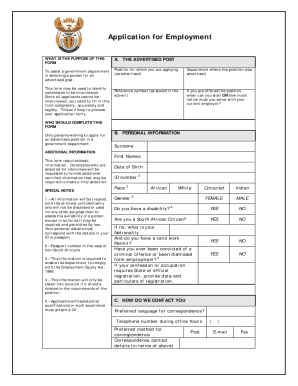

How to complete Car loan form pdf

Completing a Car loan form pdf is simple and straightforward. Follow these steps: 1. Fill in your personal information, including your name, address, and contact details. 2. Provide details about your employment, income, and any other sources of income. 3. Enter information about the vehicle you wish to purchase, including make, model, and VIN. 4. Review the form carefully to ensure all information is accurate. 5. Sign and date the form to certify the information provided is true and accurate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.