Loan Estimate Template Free - Page 2

What is Loan estimate template free?

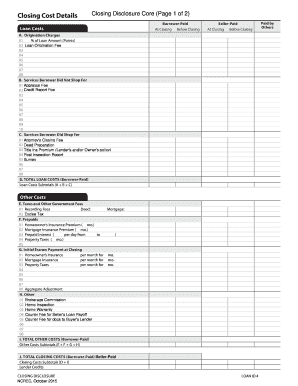

A Loan estimate template free is a document that provides detailed information about the terms and costs of a loan. It is a useful tool for borrowers to understand the expenses associated with borrowing money.

What are the types of Loan estimate template free?

There are several types of Loan estimate template free available, including:

Mortgage Loan estimate template free

Personal Loan estimate template free

Business Loan estimate template free

How to complete Loan estimate template free

Completing a Loan estimate template free is easy and straightforward. Here are some steps to follow:

01

Fill in your personal information

02

Provide details about the loan amount and terms

03

Review the document carefully before signing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan estimate template free

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 3 day loan estimate rule?

You must receive a loan estimate within three business days of completing a loan application. Because mortgage rates change daily, you should collect all of your rate quotes on the same date to make apples-to-apples comparisons. Loan term. The longer the term, the higher the interest rate.

What forms create the loan estimate?

The CFPB created the Loan Estimate Form by combining the Good Faith Estimate and Truth-In-Lending Form.

What is the 7 day rule for loan estimate?

The 7 Day Waiting Period: Use the precise definition of Business Day here. Consummation may occur on or after the seventh business day after the delivery or mailing of the initial Loan Estimate.

What is the 7 day disclosure rule?

Under the TRID rule, the creditor must deliver or place in the mail the initial Loan Estimate at least seven business days before consummation, and the consumer must receive the initial Closing Disclosure at least three business days before consummation.

What is the 3 7 3 rule in mortgage terms?

0:18 0:58 What is the TRID 3-7-3 Rule? - YouTube YouTube Start of suggested clip End of suggested clip Period. So a loan cannot close before the seventh. Business day after the initial closing disclosureMorePeriod. So a loan cannot close before the seventh. Business day after the initial closing disclosure is provided that's the 7..

What is the Trid 7 day closing rule?

Under the TRID rule, credit unions generally must provide the Loan Estimate to consumers no later than seven business days before consummation. Members must receive the Closing Disclosure no later than three business days before consummation.