Loan Estimate Form 2020

What is Loan estimate form 2020?

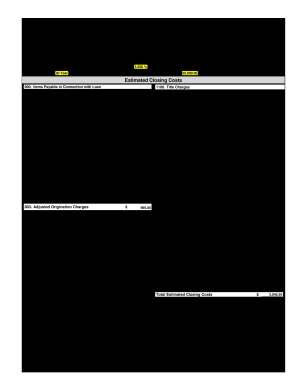

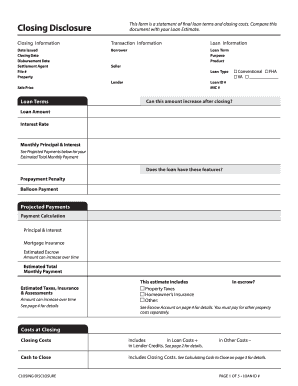

The Loan Estimate form 2020 is a standardized form that provides important information about the terms and costs of a mortgage loan. It includes details such as the loan amount, interest rate, monthly payment, and closing costs.

What are the types of Loan estimate form 2020?

There are two main types of Loan Estimate form 2020: 1. Purchase Loan Estimate - Used for home purchase loans. 2. Refinance Loan Estimate - Used for refinancing existing mortgage loans.

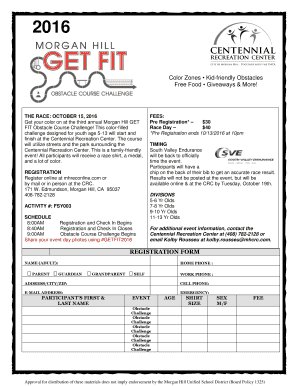

Purchase Loan Estimate

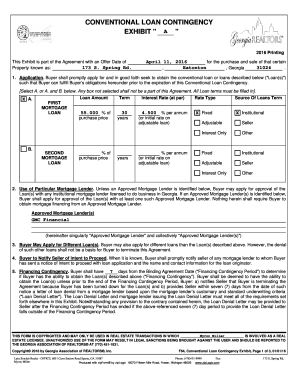

Refinance Loan Estimate

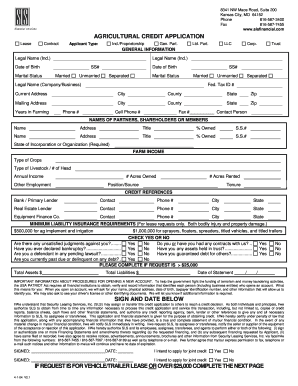

How to complete Loan estimate form 2020

To complete the Loan Estimate form 2020, follow these steps:

01

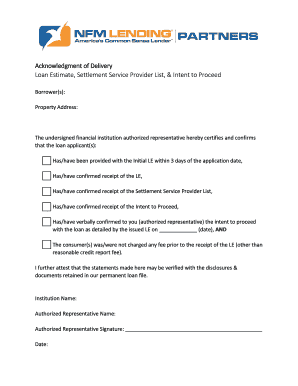

Fill in your personal information, including name, address, and Social Security number.

02

Review the loan terms and make sure all information is accurate.

03

Sign and date the form to acknowledge that you have received the Loan Estimate.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Loan estimate form 2020

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What triggers a new 3 day waiting period?

The requirement for the additional three business-day waiting period once the Closing Disclosure has been delivered applies under three specific scenarios: 1) an inaccurate APR, which violates the established tolerances. 2) the addition of a prepayment penalty. or, 3) a change in the loan product.

What happens if a loan estimate is not sent within the 3 days?

If you did not get a Loan Estimate within three business days of submitting an application for a mortgage loan, contact your lender and ask if the Loan Estimate has been sent and when it was sent. The lender is required to send you a Loan Estimate within three business days of receiving your application.

What is the 3 day rule for Trid?

The three-day period is meas- ured by days, not hours. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing.

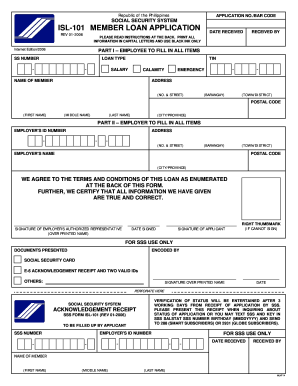

Who must receive the loan estimate?

A Loan Estimate is a three-page form that you receive after applying for a mortgage. The Loan Estimate tells you important details about the loan you have requested. The lender must provide you a Loan Estimate within three business days of receiving your application.

What is the 3 day loan estimate rule?

You must receive a loan estimate within three business days of completing a loan application. Because mortgage rates change daily, you should collect all of your rate quotes on the same date to make apples-to-apples comparisons. Loan term. The longer the term, the higher the interest rate.

What is Form H 24?

H-24(G) Mortgage Loan Transaction Loan Estimate - Modification to Loan Estimate for Transaction Not Involving Seller - Model Form. H-25(A) Mortgage Loan Transaction Closing Disclosure - Model Form.