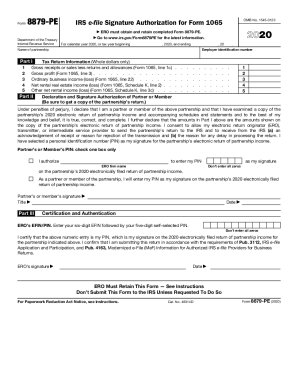

2020 Form 1065 Instructions

What is 2020 form 1065 instructions?

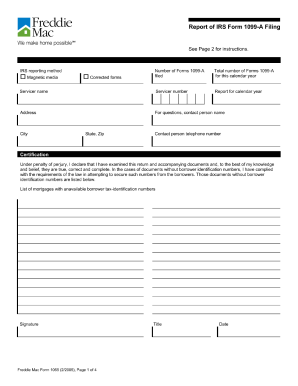

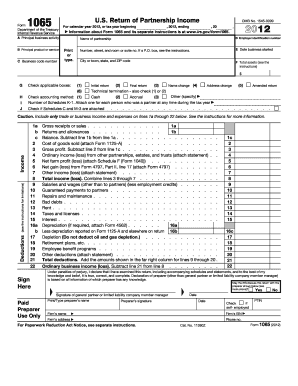

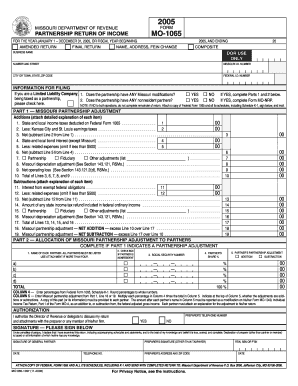

The 2020 form 1065 instructions are a set of guidelines provided by the Internal Revenue Service (IRS) to help partnerships and limited liability companies (LLCs) fill out their tax return forms accurately.

What are the types of 2020 form 1065 instructions?

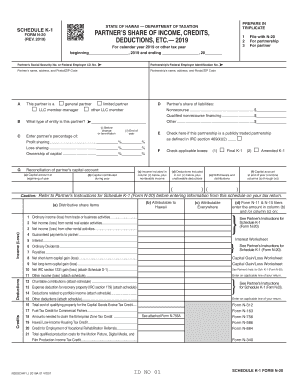

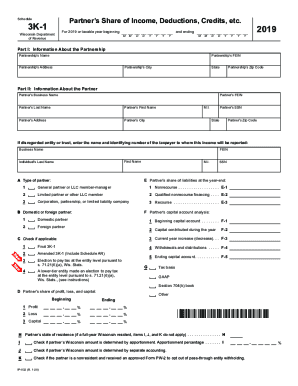

The types of 2020 form 1065 instructions include general information on partnership tax returns, specific instructions on how to report income, deductions, and credits, and guidelines on how to properly fill out Schedule K-1 forms.

General information on partnership tax returns

Specific instructions on income, deductions, and credits

Guidelines on filling out Schedule K-1 forms

How to complete 2020 form 1065 instructions

To complete the 2020 form 1065 instructions, follow these steps:

01

Gather all necessary financial documents and records related to your partnership or LLC

02

Carefully read through the instructions provided by the IRS for form 1065

03

Fill out the form accurately, making sure to report all income, deductions, and credits correctly

04

Review the completed form for any errors or omissions before submitting it to the IRS

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out 2020 form 1065 instructions

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Where can I get form 1065 for 2020?

▶ Go to .irs.gov/Form1065 for instructions and the latest information. For calendar year 2020, or tax year beginning , 2020, ending , 20 .

What is IRS Schedule K 1 form 1065 for 2020?

Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc. The partnership files a copy of Schedule K-1 (Form 1065) with the IRS to report your share of the partnership's income, deductions, credits, etc.

Does everyone file a Schedule K-1 form 1065?

While individual taxpayers typically don't file K-1 forms, you can use the information you receive from a K-1 on your personal income tax return. There are four main types of entities that are required to file a K-1: Business partnerships. LLCs that have at least two partners or elect to be taxed as corporations.

How do I order 2020 tax forms and instructions?

Get federal tax forms Download them from IRS.gov. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

What is a K-1 form 1065 for 2020?

Purpose of Schedule K-1 The partnership uses Schedule K-1 to report your share of the partnership's income, deductions, credits, etc. Keep it for your records. Do not file it with your tax return unless you are specifically required to do so.

What is the filing deadline for 2020 partnership 1065 returns?

Businesses organized as partnerships, including multi-member LLCs, and S-Corporations need to file Form 1065, or 1120S by March 15, 2023, if they are a calendar year business. If your business uses a fiscal year, you need to file your tax return by the 15th day of the third month following the close of your tax year.