Simple Credit Application Form

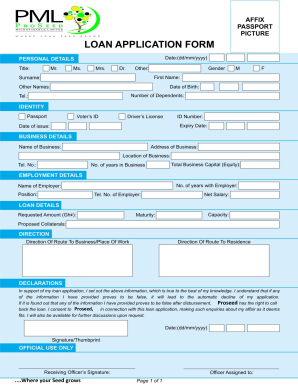

What is Simple credit application form?

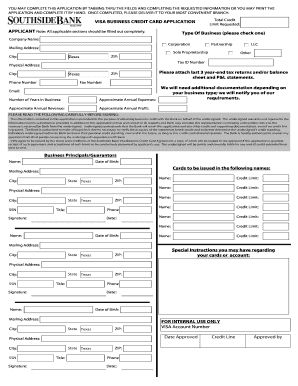

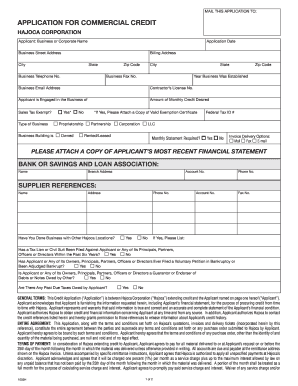

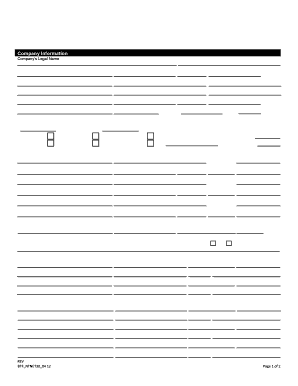

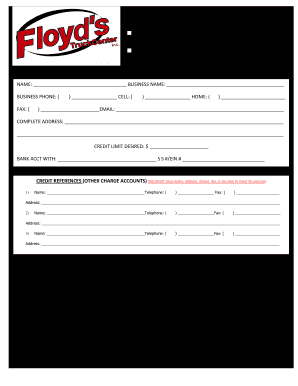

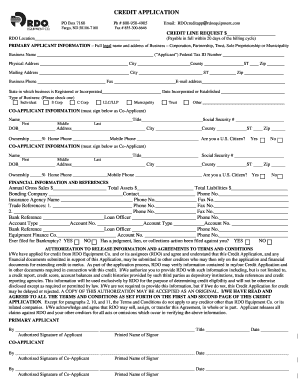

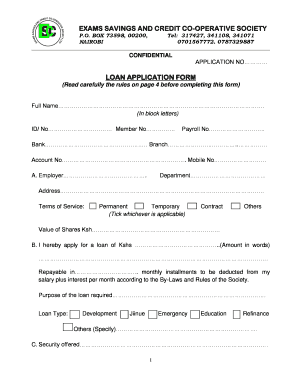

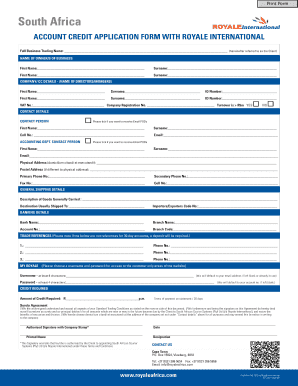

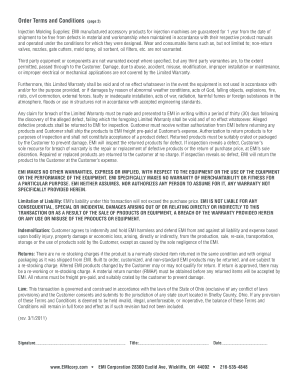

A Simple credit application form is a document that individuals or businesses fill out to apply for credit from a lender. This form typically asks for personal, financial, and credit information to assess the applicant's creditworthiness.

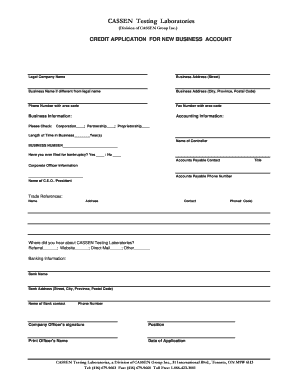

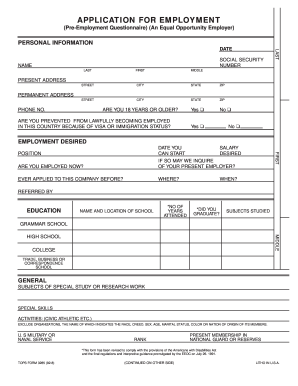

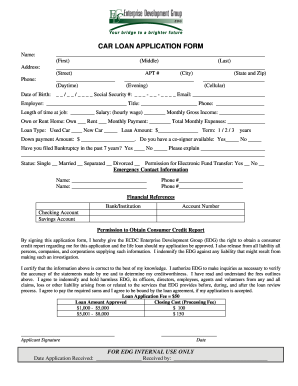

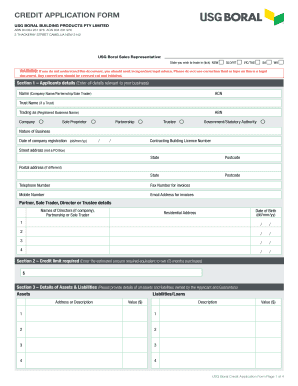

What are the types of Simple credit application form?

There are different types of Simple credit application forms tailored for specific purposes. Some common types include: personal credit application form, business credit application form, and joint credit application form.

Personal credit application form

Business credit application form

Joint credit application form

How to complete Simple credit application form

To successfully complete a Simple credit application form, follow these steps:

01

Provide accurate personal and financial information

02

Complete all required fields

03

Attach any necessary supporting documents

04

Review the information for accuracy before submission

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Simple credit application form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What happens when you submit a credit application?

Most of the time, applying for a credit card will trigger a hard inquiry into your credit report, which means that the card issuer will pull your credit report to check your creditworthiness. A hard inquiry will cause your credit score to go down a bit, but the effect is only short-term.

How to create a business credit application form?

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

What is the importance of credit application form?

A credit application provides a path for mitigating risk, even though it does not eliminate it. Instead, it establishes rules between you (the seller) and your customer (the buyer), so both of you understand what's expected.

What is credit application forms?

A credit application fulfils two main purposes: It provides the lender with enough details to determine the borrower's likeliness to repay the loan. It provides the borrower with details to determine the cost of credit, such as interest rates and fees.

What is a credit application letter?

A credit application is a borrower's formal request to a lender for an extension of credit. Credit applications can be made either orally or in written form, as well as online.

What is credit application form for business?

The purpose of a business credit application is to assess the creditworthiness of the business seeking credit and to determine the level of risk involved in extending credit to that business.

Related templates