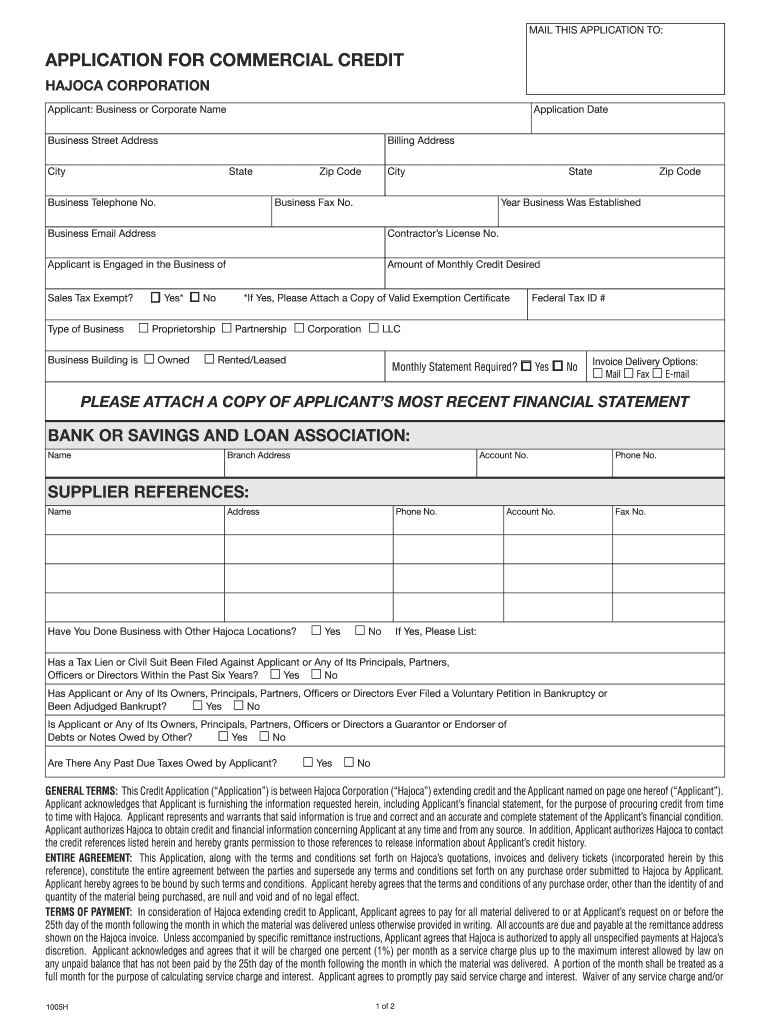

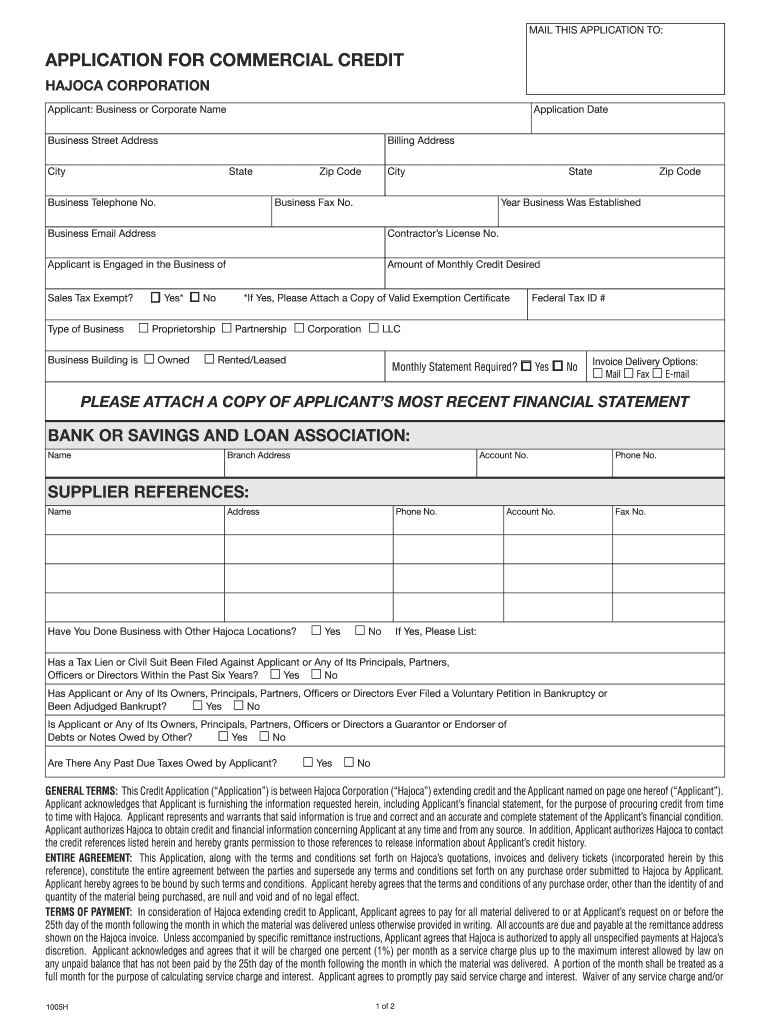

Hajoca Corporation Application for Commercial Credit free printable template

Get, Create, Make and Sign commercial credit application template form

Editing application commercial credit blank online

Uncompromising security for your PDF editing and eSignature needs

How to fill out commercial credit application form template

How to fill out Hajoca Corporation Application for Commercial Credit

Who needs Hajoca Corporation Application for Commercial Credit?

Video instructions and help with filling out and completing application commercial credit sample

Instructions and Help about application commercial credit

Welcome everyone this is Scott and bomb from a legion partners Clearview commercial division, and today we will be showing you how to fill out a commercial credit application it's a very simple process it's a secure application it can be filled out on either your desktop computer in addition to your smartphone or your tablet so if you're out and about in the field or just not too available to get into the office or to your computers to fill out the application feel free to fill this out on your smartphone or tablet where it can be processed on those devices to as well just to start off here just to let you know anything with an asterisk is a required field anything without an asterisk does not need to be filled out for the actual form so let's go ahead and get started so here we'll fill out a team corporation for the full legal business name corporation DBA team rental business type in this case team corporation is a corporation and then the federal tax ID and this is an is one that please note you do not have to have this because oh I can't remember what it is just off the top of my head and I want to get this filled out right away, so you don't need that to information right now when it comes to documentation we do ask for that piece of information but up front not needed industry team corporation is in the rental industry business phone 1545 140 4-7 business fax is not needed hardly receive any faxes anymore, so I'm going to go ahead and leave that blank business country is in the United States and now for the business address 999 Fifth Avenue suite 590 business city San Rafael California I 4901 for those of you who are curious that is just north of San Francisco as soon as you cross the Golden Gate Bridge about 220 miles north you have a different mailing address so if you have a p.o box or another physical office that you want everything to go to your want to click yes in this case for my example the answer is no is this a home-based business so is this the business that's located out of your personal residence in this case this is an actual business office outside the home and so the answer is no for my example do you own or rent, so this has to do with whether that you own your own personal home if you are the actual applicant and so own or rent and so click one or the other depending upon which one is the case for you then state of incorporation so in this case this business team corporation is incorporated in the state of California some circumstances businesses are incorporated in states outside where they are actually physically located such as Delaware is a very common state set for businesses to be located then the date established and so this is a key piece of information for those businesses who incorporated on a later date, but your first initially set up just individually on your own as a sole proprietor please give yourself credit for when your business with actually established rather than actually incorporated and so on of...

People Also Ask about corporation application credit

What is a credit template?

What should be on a credit application form?

What is a commercial credit application?

How to do a credit application for business?

How do you draft a credit application?

How to fill credit application form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hajoca application credit to be eSigned by others?

How do I make changes in application commercial credit template?

How do I make edits in application commercial credit fillable without leaving Chrome?

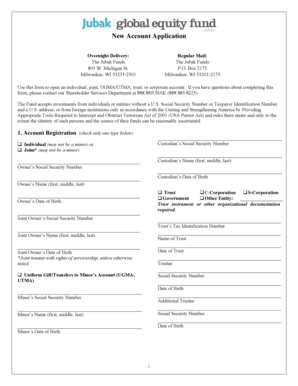

What is Hajoca Corporation Application for Commercial Credit?

Who is required to file Hajoca Corporation Application for Commercial Credit?

How to fill out Hajoca Corporation Application for Commercial Credit?

What is the purpose of Hajoca Corporation Application for Commercial Credit?

What information must be reported on Hajoca Corporation Application for Commercial Credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.