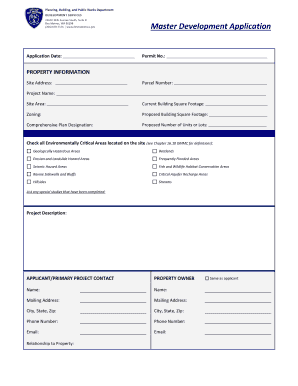

What is Credit Application Form?

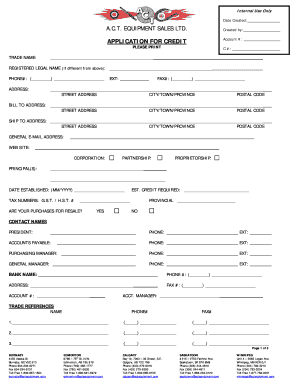

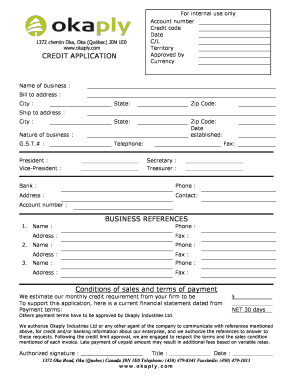

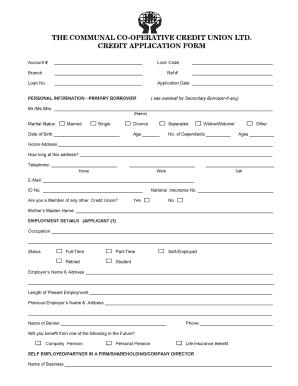

A Credit Application Form is a document that individuals or businesses use to apply for credit from a financial institution or a lender. It includes various sections that request personal and financial information to assess the borrower's creditworthiness and determine if they qualify for the requested credit.

What are the types of Credit Application Form?

There are different types of Credit Application Forms based on the specific purpose or nature of the credit being applied for. Some common types include:

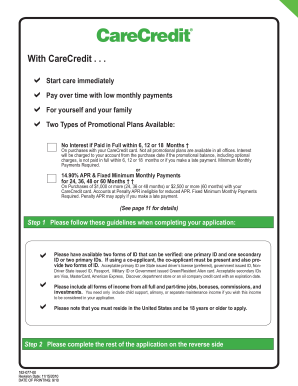

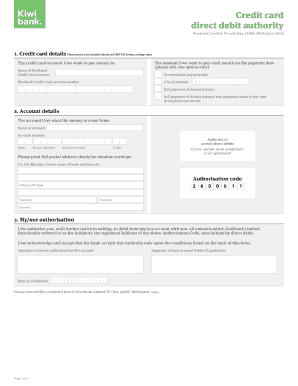

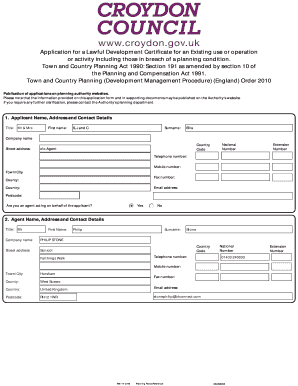

Personal Credit Application Form: This type is used by individuals to apply for personal loans or credit cards.

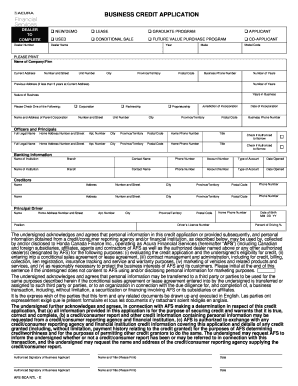

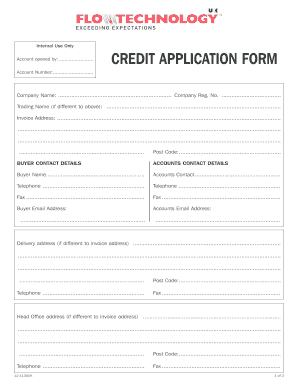

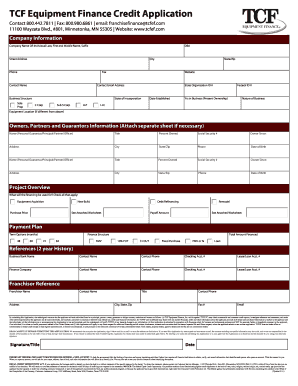

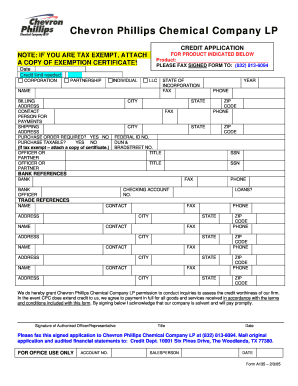

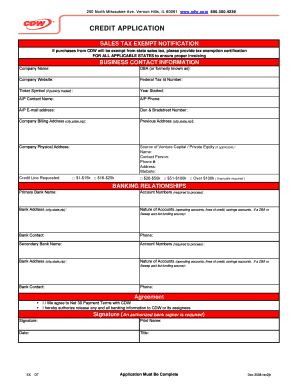

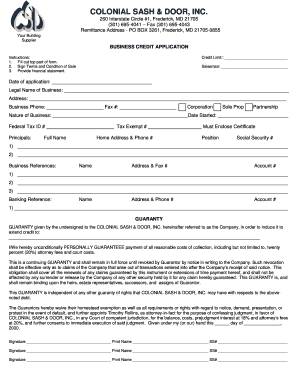

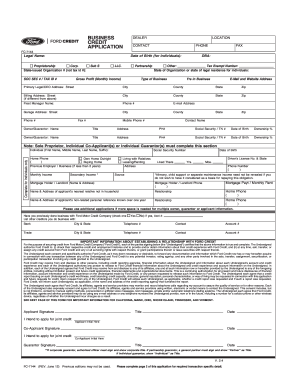

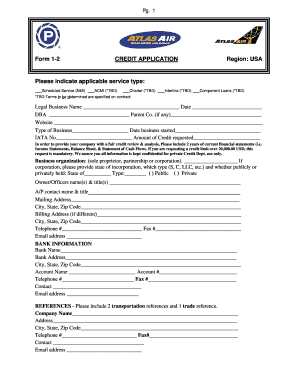

Business Credit Application Form: This form is utilized by businesses to request credit for various purposes, such as expanding operations or purchasing inventory.

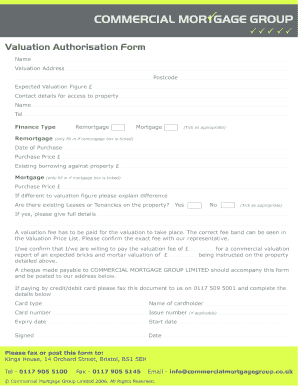

Mortgage Loan Application Form: This form is specific to mortgage loan applications and includes detailed information about the property being financed.

Vehicle Loan Application Form: Used when applying for a loan to purchase a vehicle.

Student Loan Application Form: Designed for students seeking financial assistance for their education.

How to complete Credit Application Form

Completing a Credit Application Form may vary slightly depending on the specific form and lender's requirements. However, here are some general steps to follow:

01

Provide Personal Information: Fill in your full name, contact details, social security number, date of birth, and any other required personal information.

02

Financial Information: Enter details about your income, employment status, assets, and any existing debts or liabilities.

03

Credit Request: Specify the type and amount of credit you are applying for. Provide details about the purpose of the credit and any collateral you may offer.

04

Authorization: Review the terms and conditions, then sign and date the form to authorize the lender to process your application.

05

Submit the Form: Once completed, submit the form to the lender either online, through mail, or in person as per their instructions.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.