Business Credit Application

What is Business Credit Application?

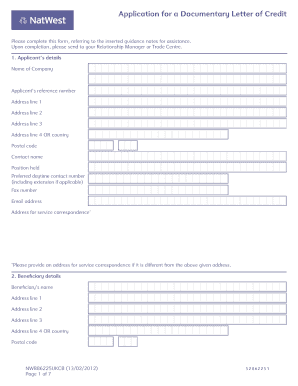

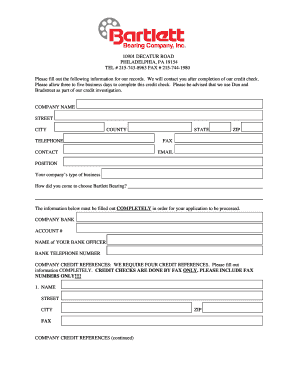

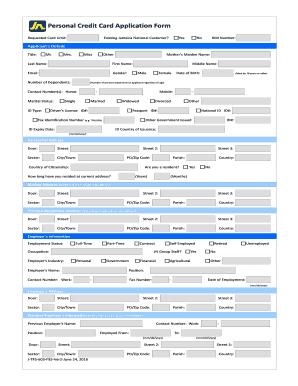

A Business Credit Application is a form that businesses use to apply for credit from a financial institution or supplier. It provides the necessary information for the lender or supplier to evaluate the creditworthiness of the business and make an informed decision on whether to extend credit. The application typically includes details such as the business's legal name, address, industry, years in operation, financial statements, and references.

What are the types of Business Credit Application?

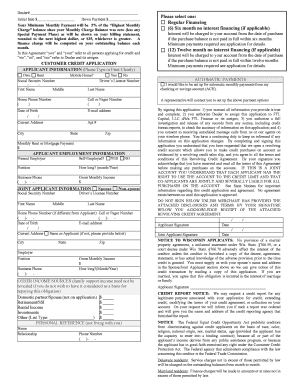

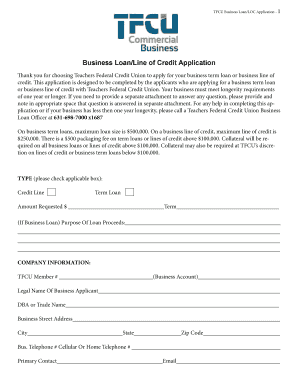

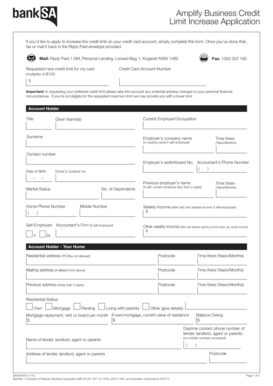

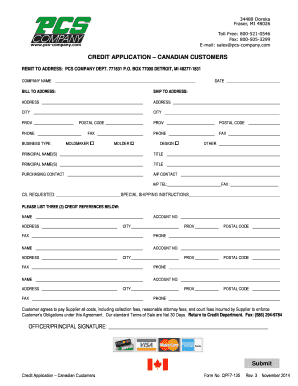

There are several types of Business Credit Applications, each tailored to specific lending institutions or suppliers. Some common types include: 1. Commercial Credit Application: This type of application is used when a business seeks credit from a commercial bank or financial institution. 2. Supplier Credit Application: Businesses often need credit from suppliers to purchase goods or services. A supplier credit application is designed for this purpose. 3. Trade Credit Application: Trade credit refers to credit extended by one business to another for the purchase of goods or services. A trade credit application is used in such scenarios. 4. Small Business Credit Application: Specifically designed for small businesses, this application takes into account the unique financial needs and challenges faced by these enterprises.

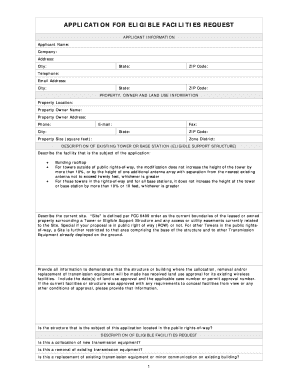

How to complete Business Credit Application

Completing a Business Credit Application requires attention to detail and accurate information. Here are the steps to follow: 1. Gather necessary documents: Collect all required documents such as financial statements, tax returns, legal entity documents, and references. 2. Fill in business details: Provide accurate information about your business, including legal name, address, contact information, industry, and years in operation. 3. Provide financial information: Share financial statements, including balance sheets, income statements, and cash flow statements. 4. Include references: Provide references from other businesses or individuals who can vouch for your creditworthiness. 5. Review and submit: Double-check all the information provided, make any necessary corrections, and submit the completed application to the lender or supplier.

pdfFiller is an online platform that empowers users to create, edit, and share documents online. With unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done efficiently. Whether you're completing a Business Credit Application or any other document, pdfFiller simplifies the process, saving you time and effort.