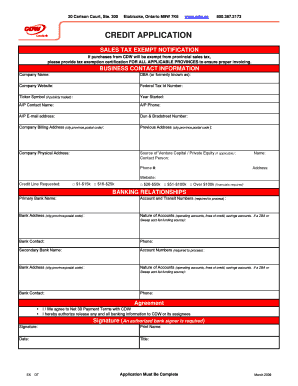

Credit Application

What is Credit Application?

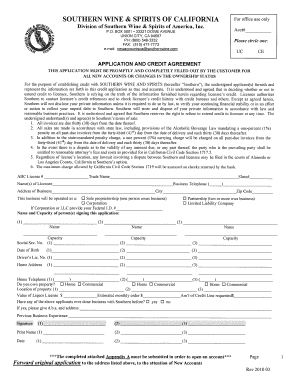

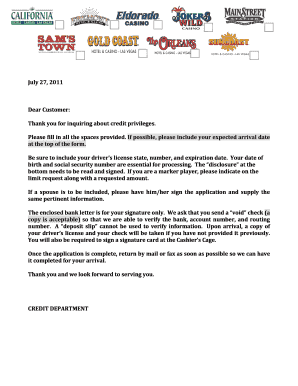

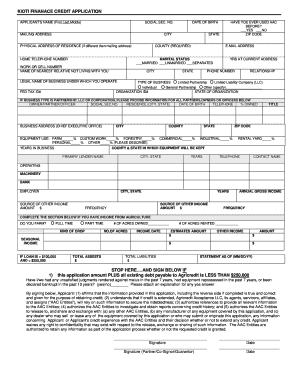

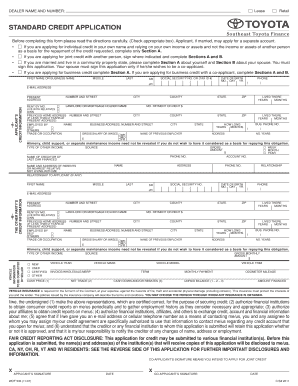

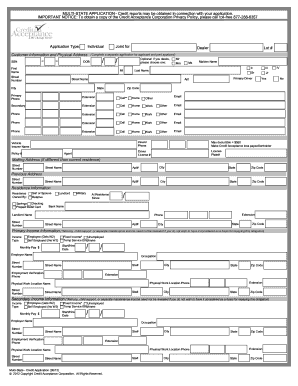

A Credit Application is a form used by individuals or businesses to apply for credit from a lender. It includes personal or business information, financial details, and credit history to help the lender assess the applicant's creditworthiness.

What are the types of Credit Application?

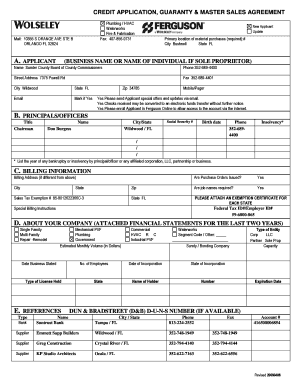

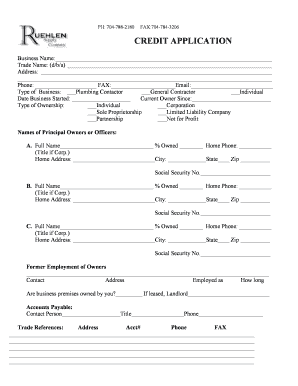

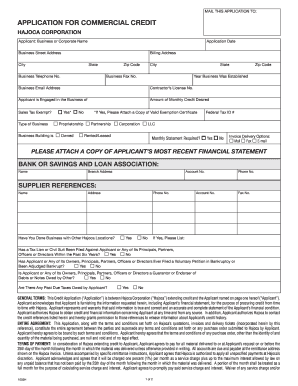

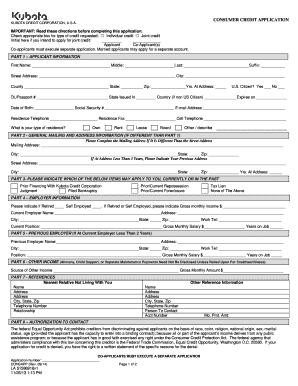

There are various types of Credit Applications depending on the type of credit being applied for. Some common types include: - Personal Credit Application - Business Credit Application - Mortgage Loan Application - Credit Card Application - Auto Loan Application

How to complete Credit Application

To complete a Credit Application, follow these steps: 1. Gather all necessary information such as personal details, financial information, and credit history. 2. Fill out the application accurately and completely. 3. Double-check all information for accuracy. 4. Submit the application to the lender for review.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.