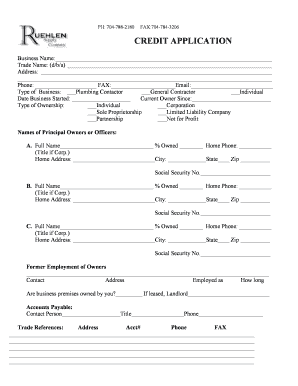

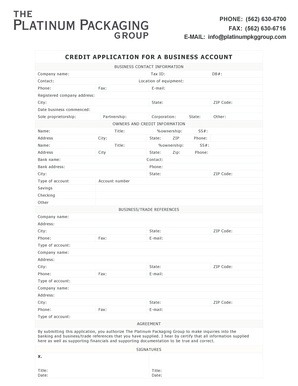

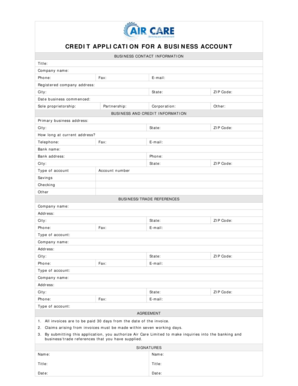

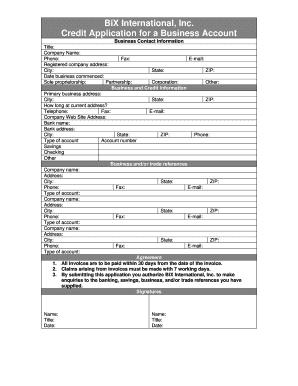

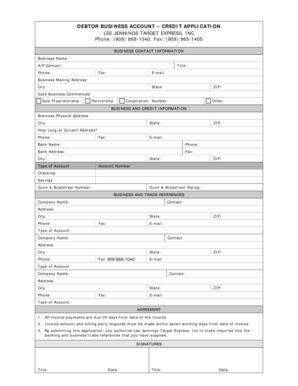

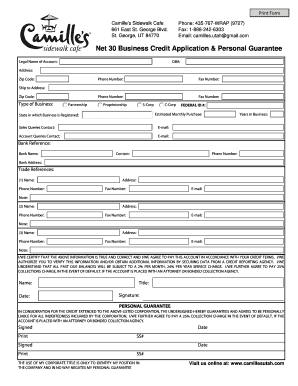

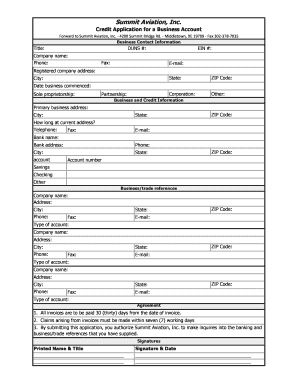

Credit Application For A Business Account

What is Credit Application For A Business Account?

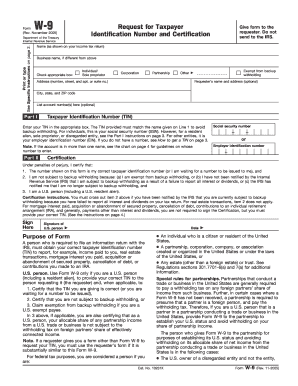

A Credit Application For A Business Account is a document that businesses use to apply for credit with suppliers and financial institutions. This application provides essential information about the business, such as its financial history, creditworthiness, and ability to repay the credit. It is a crucial step in establishing a business credit profile and obtaining credit for business operations.

What are the types of Credit Application For A Business Account?

There are two main types of Credit Application For A Business Account: individual credit applications and corporate credit applications. An individual credit application is used when an individual business owner or sole proprietor applies for credit. On the other hand, a corporate credit application is used when a business entity, such as a corporation or LLC, applies for credit on behalf of the business. Both types of applications require similar information, but the corporate application may also require additional details about the business structure and ownership.

How to complete Credit Application For A Business Account

Completing a Credit Application For A Business Account is a straightforward process. Here are the steps to follow:

pdfFiller offers a convenient solution for completing Credit Applications For A Business Account. With its unlimited fillable templates and powerful editing tools, users can easily create, edit, and share credit applications online. pdfFiller streamlines the process, eliminating the need for manual paperwork and ensuring accuracy in the application. Start using pdfFiller today to simplify your credit application process and get your documents done efficiently.