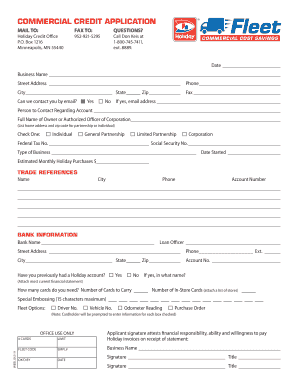

Commercial Credit Application Form

What is a commercial credit application form?

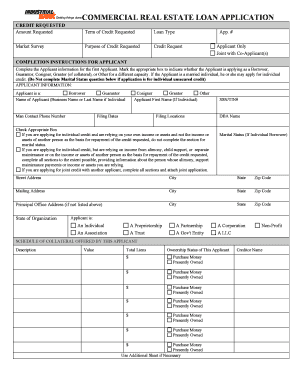

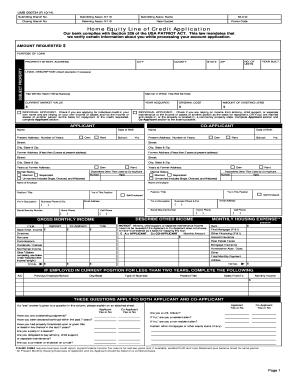

A commercial credit application form is a document that businesses use to gather all the necessary information from potential customers who want to apply for credit. This form helps businesses assess the creditworthiness of their customers and make informed decisions about extending credit.

What are the types of commercial credit application forms?

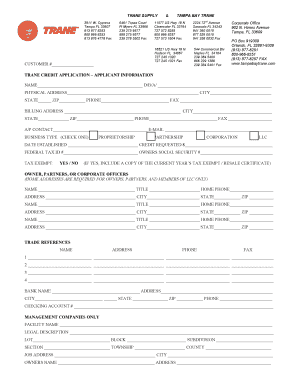

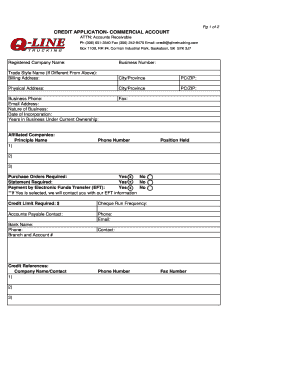

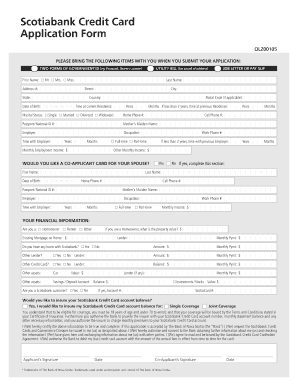

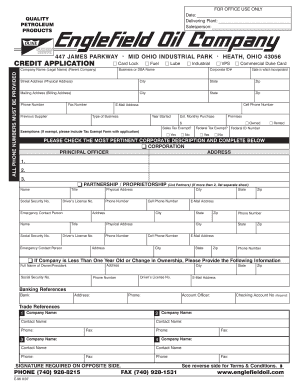

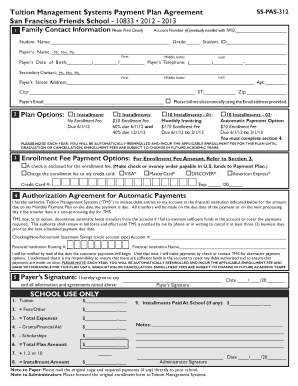

There are several types of commercial credit application forms tailored to different industries and business needs. Some common types include:

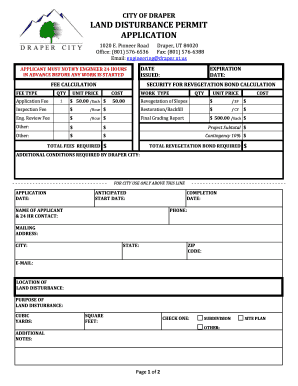

How to complete a commercial credit application form

Completing a commercial credit application form is crucial for both businesses and customers. To ensure a smooth process, follow these steps:

pdfFiller offers a solution for creating, editing, and sharing documents online, including commercial credit application forms. With unlimited fillable templates and powerful editing tools, pdfFiller makes it easy for businesses to streamline their credit application process and make informed credit decisions.