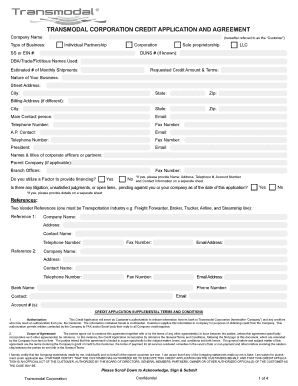

Customer Credit Application Form And Agreement

What is customer credit application form and agreement?

A customer credit application form and agreement is a document used by businesses to collect information from customers who are seeking credit. It serves as an application for credit and also outlines the terms and conditions of the credit agreement. By filling out this form, customers provide their personal and financial information to the business, which helps the business assess their creditworthiness and make informed decisions regarding the extension of credit.

What are the types of customer credit application form and agreement?

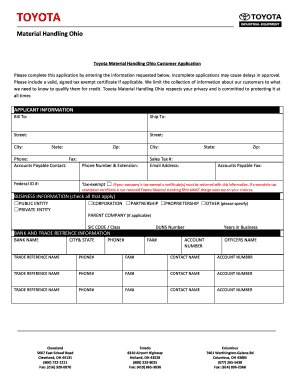

There are several types of customer credit application forms and agreements, each tailored to specific industries or purposes. Some common types include:

How to complete customer credit application form and agreement

Completing a customer credit application form and agreement is a straightforward process. Here are the steps to follow:

With pdfFiller's comprehensive collection of fillable templates and advanced editing tools, completing and sharing customer credit application forms and agreements has never been easier. Save time and effort by using pdfFiller for all your document needs!