Customer Credit Application Form And Agreement Template

What is Customer credit application form and agreement template?

A Customer credit application form and agreement template is a document used by businesses to establish credit terms and agreements with their customers. It outlines the terms and conditions of extending credit to a customer, including payment terms, credit limits, and penalties for late payments.

What are the types of Customer credit application form and agreement template?

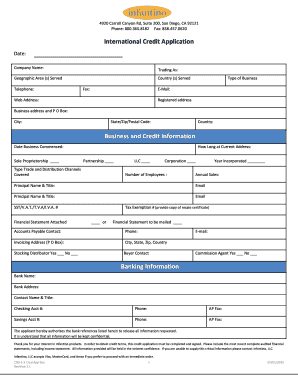

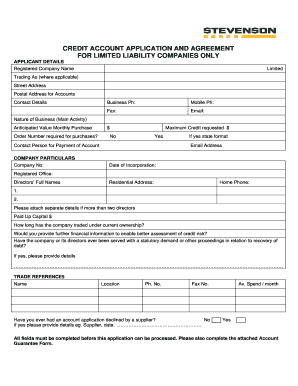

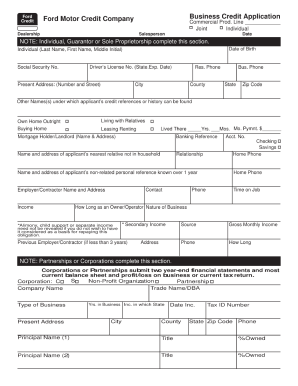

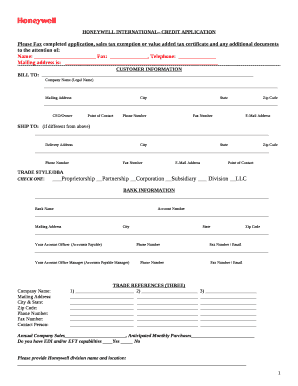

There are different types of Customer credit application form and agreement templates tailored to specific industries and businesses. Some common types include: 1. Standard Customer Credit Application Form 2. Wholesale Customer Credit Application Form 3. Retail Customer Credit Application Form 4. Service-based Customer Credit Application Form 5. International Customer Credit Application Form

How to complete Customer credit application form and agreement template

Completing a Customer credit application form and agreement template is a straightforward process that involves providing accurate information and agreeing to the terms outlined. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.