Partnership Tax Return Form Templates

What are Partnership Tax Return Form Templates?

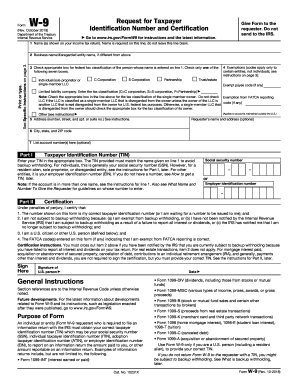

Partnership Tax Return Form Templates are standardized documents used by partnerships to report their income, deductions, and other financial information to the IRS. These templates help partnerships comply with tax laws and ensure accurate reporting of financial data.

What are the types of Partnership Tax Return Form Templates?

There are several types of Partnership Tax Return Form Templates based on the specific tax situations of the partnership. Some common types include:

How to complete Partnership Tax Return Form Templates

Completing Partnership Tax Return Form Templates can seem daunting, but with the right guidance, it can be a straightforward process. Here are some steps to help you complete the templates effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.