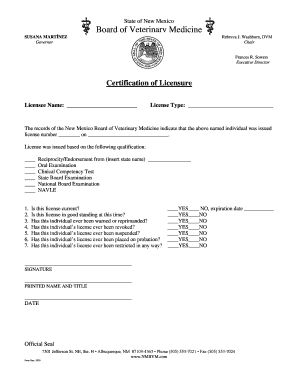

Ill Health Retirement Certificate

What is Ill health retirement certificate?

An Ill health retirement certificate is a document issued to employees who are unable to continue working due to health reasons. It serves as proof of their medical condition and the need to retire early.

What are the types of Ill health retirement certificate?

There are two main types of Ill health retirement certificates:

Temporary Ill-Health Certificate

Permanent Ill-Health Certificate

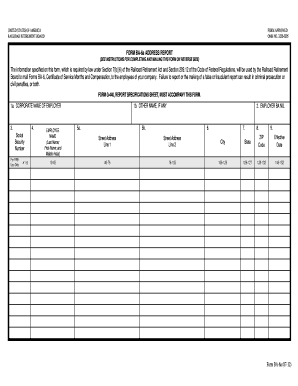

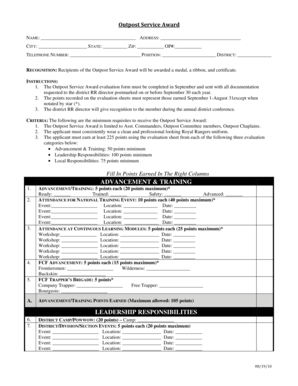

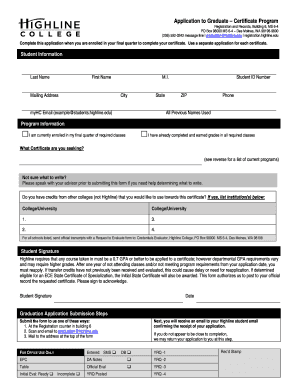

How to complete Ill health retirement certificate

To complete an Ill health retirement certificate, follow these steps:

01

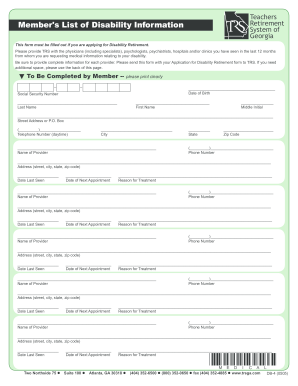

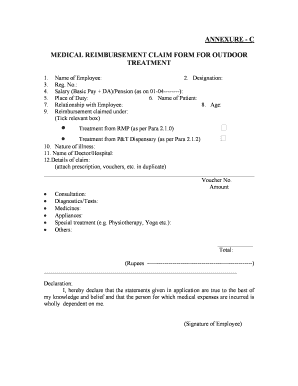

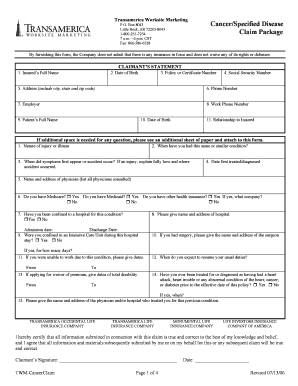

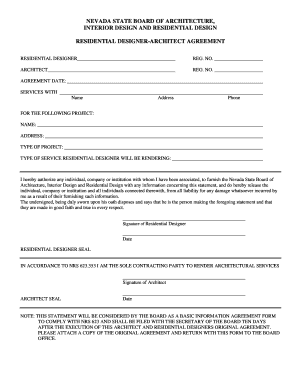

Fill out personal information such as name, date of birth, and employee identification number.

02

Provide details of your medical condition and the reasons for early retirement.

03

Have your healthcare provider sign and certify the form.

04

Submit the completed form to your HR department for processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Ill health retirement certificate

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is an ill health retirement certificate?

Ill health retirement – also known as being 'medically retired' – is when you are permitted to draw your pension before the age of 55 (or the scheme's ordinary retirement date) due to sickness, disability or other medical condition.

What is Tier 1 ill health retirement?

If you are unable, through illness, to work in your present job and your condition is permanent, you may be able to retire early and take your pension benefits without actuarial reduction. This is known as a tier 1 (lower tier) award.

What is the 85 year rule?

What is the Rule of 85? Member's whose age plus scheme membership (in whole years) equals 85 may be able to take their pension before their Normal Pension Age, without it being reduced for early payment.

How does the 85 factor work?

The 85 factor is calculated by adding together your age and years of pensionable service at retirement. If the total equals at least 85 points, you're entitled to an unreduced PSPP pension as early as your 55th birthday.

What is the 85 year Rule for retirement?

Many pension plans follow the Rule of 85, which says that if your age and years of service to your employer total at least 85, then you can retire early without giving up any of your pension benefits.

Is it better to take monthly pension or lump sum?

If you take a lump sum — available to about a quarter of private-industry employees covered by a pension — you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.