Travel Expense Claim Form

What is Travel expense claim form?

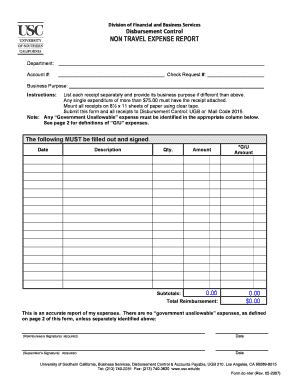

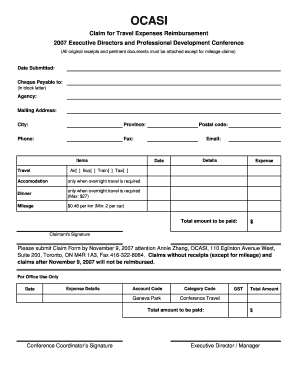

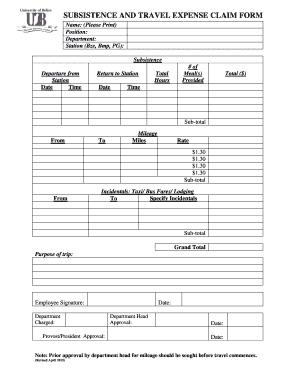

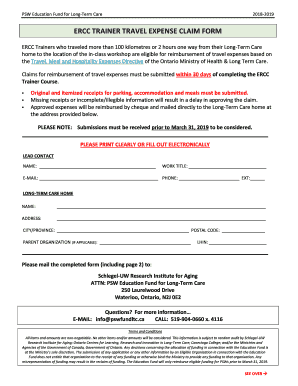

A Travel expense claim form is a document used by individuals to report expenses incurred during business trips or travel for work purposes. It helps ensure that employees are reimbursed accurately for costs they have incurred while representing their company.

What are the types of Travel expense claim form?

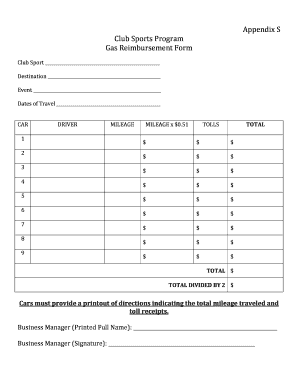

There are several types of Travel expense claim forms, including but not limited to:

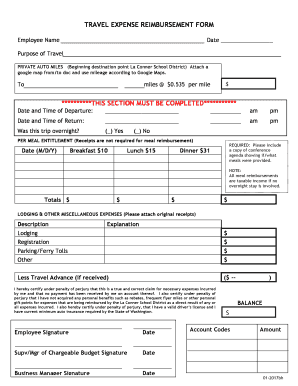

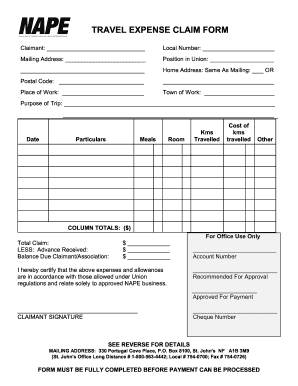

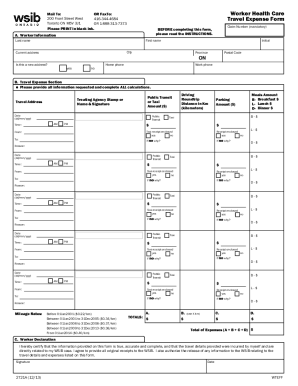

Mileage reimbursement form

Meal and entertainment expense form

Lodging and accommodation expense form

Transportation expense form

How to complete Travel expense claim form

Completing a Travel expense claim form is a straightforward process that involves the following steps:

01

Enter your personal information such as name, employee ID, and contact details

02

Itemize each expense including date, description, and cost

03

Attach relevant receipts or documentation to support each expense claimed

04

Submit the completed form to your employer for review and approval

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Travel expense claim form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the form for USPS travel reimbursement?

A travel expense reimbursement form is used by organizations to reimburse employees for travel-related expenses. Employee Information Forms. Use Template.

Can you claim reimbursed travel expenses?

Claiming your travel expenses To make your claim for travel expenses you will need to complete a P87 form and possibly a self assessment tax return depending on the value of your travel claim.

What is travel reimbursement form?

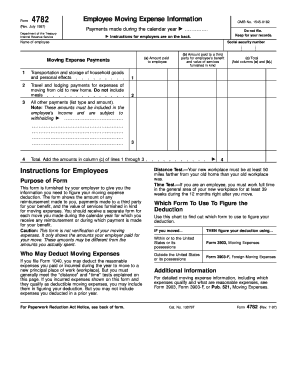

Most reimbursements for ordinary and necessary travel expenses for temporary travel are not taxable. However, if the work at the temporary location is expected to last longer than a year or for an indefinite period of time, the reimbursement is taxable.

How do I claim travel expenses?

What travel expenses to budget for Transportation. Lodging, including taxes and fees. Food and drink. Activities like museum tickets, tours, excursions, golf outings, etc. Souvenirs—anything you might buy on your trip that you wouldn't buy at home. Learn How to Budget for a Trip with Travel Expenses | Capital One capitalone.com https://.capitalone.com › bank › life-events › budge capitalone.com https://.capitalone.com › bank › life-events › budge

How do I get reimbursed for USPS travel?

All eBuy requests are subject to Postal Service eBuy policies. The Postal Service reimburses payments through eTravel (https://blue.usps.gov/accounting/travel/etravel.htm), the Postal Service's online application to create, submit, and approve official business travel expense reports for reimbursement.

Where can I get USPS forms?

The forms are available in PDF format and can be found at: http://about.usps.com/forms/all-forms.htm. Use the Postal Explorer's Business Rate Calculator to assist you in calculating postage. If a Postal facility is NOT participating in the PostalOne!