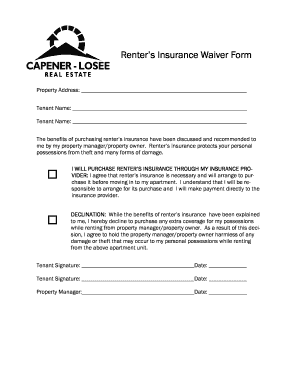

Insurance Form Example - Page 2

What is Insurance form example?

An insurance form example is a document that individuals or organizations fill out to provide information to an insurance company to request or update insurance coverage. This form typically includes details about the insured party, the policy, coverage limits, and other relevant information.

What are the types of Insurance form example?

There are several types of insurance forms that an individual or organization may need to fill out, depending on the type of insurance coverage they are seeking. Some common types of insurance forms include:

How to complete Insurance form example

Completing an insurance form example is a straightforward process that involves providing accurate and detailed information. Here are some steps to help you complete an insurance form effectively:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.