Life Insurance Questionnaire Templates - Page 2

What are Life Insurance Questionnaire Templates?

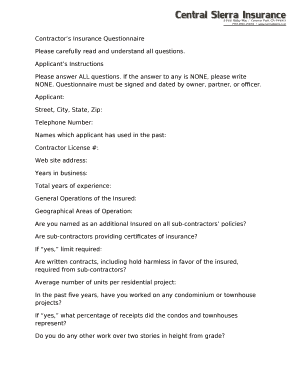

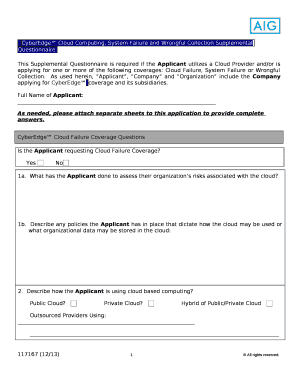

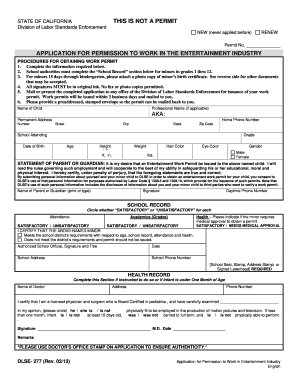

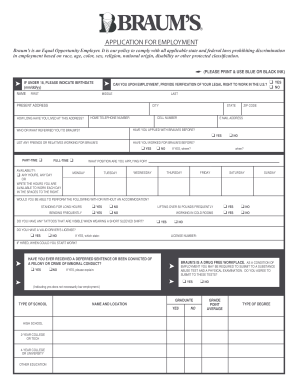

Life Insurance Questionnaire Templates are standardized forms used by insurance companies to gather information about individuals applying for life insurance policies. These templates help streamline the application process by collecting essential data about the applicant's health, lifestyle, and financial situation.

What are the types of Life Insurance Questionnaire Templates?

There are several types of Life Insurance Questionnaire Templates available, including:

How to complete Life Insurance Questionnaire Templates

Completing Life Insurance Questionnaire Templates is a straightforward process. Here are some tips to help you fill out these forms accurately:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. With pdfFiller, you can easily complete Life Insurance Questionnaire Templates and any other documents efficiently.