Compensation Formulas Excel

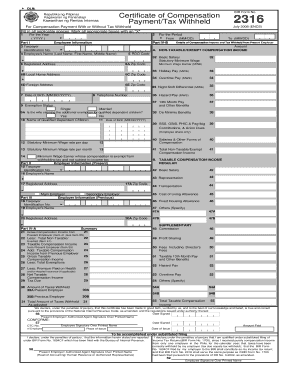

What is Compensation formulas excel?

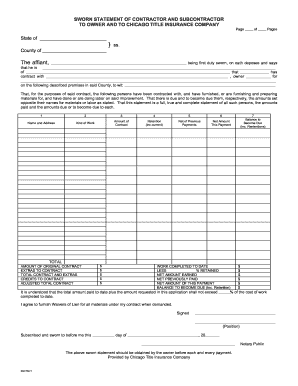

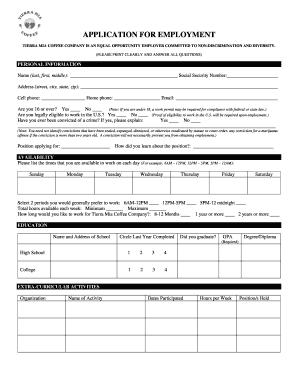

Compensation formulas excel are mathematical calculations used to determine the amount of compensation an individual should receive based on various factors such as performance, experience, and industry standards. These formulas are commonly utilized by human resources departments or businesses to ensure fair and competitive compensation packages for employees.

What are the types of Compensation formulas excel?

There are several types of compensation formulas excel that organizations may use to determine employee compensation. Some common types include:

How to complete Compensation formulas excel

To successfully complete compensation formulas excel, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.