Contractor Direct Deposit Form - Page 2

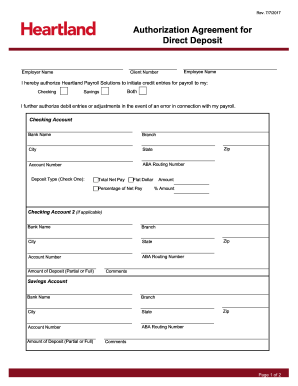

What is Contractor direct deposit form?

A Contractor direct deposit form is a document used by contractors to authorize their clients or employers to deposit payments directly into their bank accounts. It is a convenient and efficient way for contractors to receive their payments without the need for physical checks.

What are the types of Contractor direct deposit form?

There are primarily two types of Contractor direct deposit forms:

Standard Contractor direct deposit form: This is a basic form that includes essential information such as contractor's name, bank account details, and authorization for direct deposits.

Custom Contractor direct deposit form: This form can be personalized to include specific payment terms, schedules, and additional authorization requirements as per the contractor-client agreement.

How to complete Contractor direct deposit form

Completing a Contractor direct deposit form is a simple process that involves the following steps:

01

Fill in your personal information such as name, address, and contact details.

02

Provide your bank account information including account number and routing number.

03

Read and agree to the terms and conditions of direct deposit.

04

Sign and date the form to authorize the direct deposits.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Contractor direct deposit form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What form does my employer need for direct deposit?

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account.

What info does my employer need for direct deposit?

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

Who completes the direct deposit form?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account.

Do I need a voided check for direct deposit?

No. You do not need a voided check to set up direct deposit. If you're reordering checks, setting up a direct deposit or an automatic payment or preparing a wire transfer, you'll probably be asked to provide an ABA routing number. This sample check image shows where ABA routing numbers can be found on your checks.

What is the direct deposit form called?

A direct deposit authorization form is a form that employees fill out to authorize their employer to deposit money straight into their bank account. Direct deposit is the standard method most businesses use for paying employees.

How do I set up direct deposit for my employer?

Steps for Direct Deposit Setup Choose A Payroll Service Provider. Establish A Company Payroll Account. Send A Direct Deposit Authorization Form To Employees. Verify Correct Account Information. Run standard payroll process.