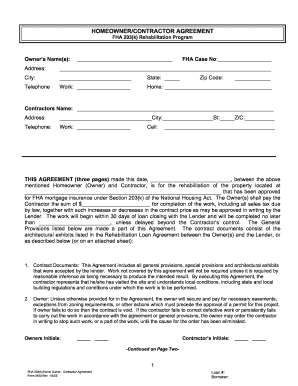

Simple Contractor Agreement

What is a Simple Contractor Agreement?

A Simple Contractor Agreement is a legal document that outlines the terms and conditions of a working relationship between a contractor and a client. It sets out the scope of work, payment terms, deadlines, and any other important details relevant to the agreement.

What are the types of Simple Contractor Agreement?

There are several types of Simple Contractor Agreements that can be used depending on the nature of the work and the relationship between the parties. Some common types include:

How to complete Simple Contractor Agreement

Completing a Simple Contractor Agreement is a straightforward process that involves the following steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.