Davis-bacon Wage Rates 2020 Pdf - Page 2

What is Davis-Bacon Wage Rates 2020 PDF?

Davis-Bacon Wage Rates 2020 PDF is a document that outlines the prevailing wage rates for laborers and mechanics working on federal government construction projects. These rates are set by the Department of Labor to ensure that workers are paid fairly and competitively.

What are the types of Davis-Bacon Wage Rates 2020 PDF?

There are several types of Davis-Bacon Wage Rates 2020 PDF, including:

General wage determination

Holiday schedule

Residential wage determinations

Conformance payrolls

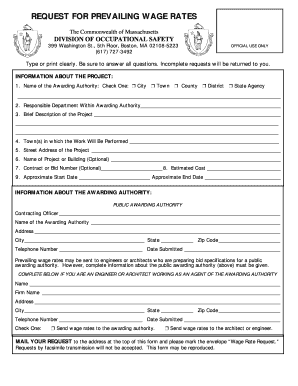

How to complete Davis-Bacon Wage Rates 2020 PDF

Completing Davis-Bacon Wage Rates 2020 PDF is easy with pdfFiller. Here are the steps:

01

Access the Davis-Bacon Wage Rates 2020 PDF template on pdfFiller

02

Fill in the required information accurately

03

Review the document for any errors or omissions

04

Save and share the completed document

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Davis-bacon wage rates 2020 pdf

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the determination of wages?

The market theory of wage determination aims to explain the discrepancies in income that a lot of different individuals get through worker's abilities. ing to this theory, the pay or salary of a worker is determined by the supply and demand for the worker's abilities and services in the market.

What are the 4 types of wage determination?

Wage Determinations are issued for four types of construction categories: building, residential, highway, and heavy.

What is wage determination easy?

A “wage determination” lists the minimum prevailing wage and fringe benefit rates that must be paid for each work classification in order to comply with prevailing wage laws, like Davis-Bacon and Related Acts (DBRA).

How much does Davis Bacon pay in Los Angeles?

County: Los Angeles County in California. Note: Under Executive Order (EO) 13658, an hourly minimum wage of $10.80 for calendar year 2020 applies to all contracts subject to the Davis-Bacon Act for which the contract is awarded (and any solicitation was issued) on or after January 1, 2015.

What is the highest prevailing wage?

Highest Prevailing Wage Threshold States Connecticut has the highest mentioned prevailing wage threshold at $1,000,000 for its new construction landscape. This means developers are often required to pay their workforce an average wage rather than a minimum one if they are on a federal contract.

What is the difference between DBA and DBRA?

Davis-Bacon Act The main difference between them is that DBA applies to work done on federal government and District of Columbia (D.C.) buildings and public property (such as national memorials or parks), while the DBRA applies to non-federal construction contracts that are funded by federal dollars.