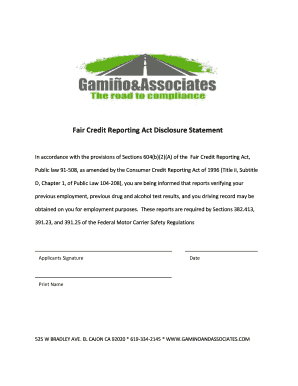

Fair Credit Reporting Act Pdf 2020 - Page 2

What is Fair credit reporting act pdf 2020?

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how consumer credit information is collected, used, and shared. The Fair Credit Reporting Act pdf 2020 is the latest version of this law in a portable document format.

What are the types of Fair credit reporting act pdf 2020?

The types of FCRA pdf 2020 include but are not limited to:

Summary of Rights under the FCRA

Notice to Users of Consumer Reports: Obligations of Users under the FCRA

Notice to Furnishers of Information: Obligations of Furnishers under the FCRA

How to complete Fair credit reporting act pdf 2020

Completing the Fair Credit Reporting Act pdf 2020 can be done easily by following these steps:

01

Download the FCRA pdf 2020 from a reliable source

02

Open the document using a pdf editor like pdfFiller

03

Fill in the required information accurately

04

Save a copy for your records and share it as needed

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fair credit reporting act pdf 2020

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the new credit law in 2023?

Consumer Credit and the Removal of Medical Collections from Credit Reports. The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.

What is the new credit score law?

What Are the New FHFA Scoring Changes? In October 2022, the FHFA announced two significant new changes: Lenders will have to provide both the FICO 10 T and VantageScore 4.0 credit scores to Fannie Mae and Freddie Mac when the GSEs purchase the lenders' mortgage loans.

What is the new FCRA law 2023?

The Bureau is amending Appendix O to Regulation V, which implements the FCRA, to establish the maximum allowable charge for disclosures by a consumer reporting agency to a consumer for 2023. The maximum allowable charge will be $14.50 for 2023.

What is the 609 Fair credit Act?

Section 609 of the Fair Credit Reporting Act (FCRA) gives you the right to request your credit card reports and any other information recorded in them. In section 611, the FCRA summarizes your rights to dispute inaccurate information found in the report.

What is covered under the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

What are the changes to credit reporting in 2023?

The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.