Fair Credit Reporting Act Pdf 2019

What is Fair credit reporting act pdf 2019?

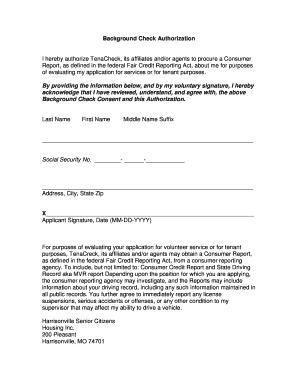

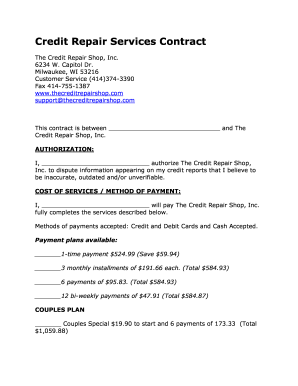

The Fair Credit Reporting Act (FCRA) is a federal law that promotes the accuracy, fairness, and privacy of information in consumer credit reports. The FCRA governs how consumer reporting agencies collect, use, and disclose credit information.

What are the types of Fair credit reporting act pdf 2019?

The types of Fair Credit Reporting Act PDF 2019 include:

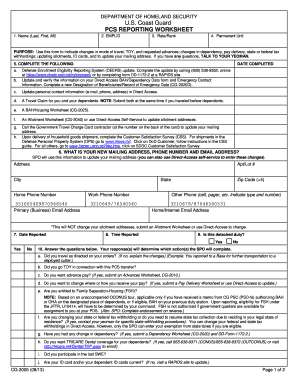

Summary of your rights under the FCRA

Notice to users of consumer reports: obligations of users under the FCRA

FCRA privacy notice: important information for consumers

A summary of your rights under the FCRA

How to complete Fair credit reporting act pdf 2019

To complete the Fair Credit Reporting Act PDF 2019, follow these steps:

01

Download the PDF from a trusted source.

02

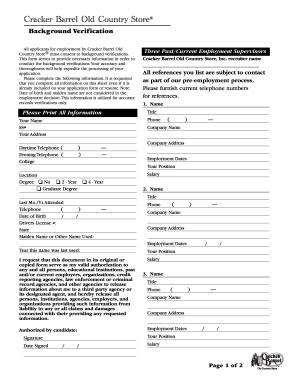

Fill in your personal information accurately.

03

Review the document for any errors or missing information.

04

Save or print the completed document for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fair credit reporting act pdf 2019

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is the 15 1681 Fair Credit Reporting Act?

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit reporting. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.

What is covered under the Fair Credit Reporting Act?

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

How do I comply with Fair Credit Reporting Act?

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: Step 2: Certification To The Consumer Reporting Agency. Step 3: Provide Applicant With Pre-Adverse Action Documents. Step 4: Notify Applicant Of Adverse Action.

What is 15 us code 5 1681b?

In response to the order of a court having jurisdiction to issue such an order, a subpoena issued in connection with proceedings before a Federal grand jury, or a subpoena issued in ance with section 5318 of title 31 or section 3486 of title 18.

What is the new credit law in 2023?

Consumer Credit and the Removal of Medical Collections from Credit Reports. The three nationwide consumer reporting companies announced the removal of medical collections under $500 from consumer credit reports on April 11, 2023.

What is the 1681 Fair Credit Reporting Act?

[15 U.S.C. § 1681] (1) The banking system is dependent upon fair and accurate credit report- ing. Inaccurate credit reports directly impair the efficiency of the banking system, and unfair credit reporting methods undermine the public confidence which is essential to the continued functioning of the banking system.