609 And 611 Letter

What is a 609 and 611 letter?

A 609 letter is a written request sent to a creditor or credit bureau asking for verification of a debt. A 611 letter is similar but specifically targets credit bureaus and requests a thorough investigation of items on your credit report.

What are the types of 609 and 611 letter?

There are two main types of letters: the 609 letter, which is used to challenge the validity of a debt with a creditor, and the 611 letter, which disputes inaccuracies on your credit report. Both letters are powerful tools in managing your credit.

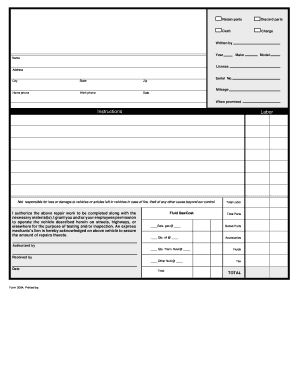

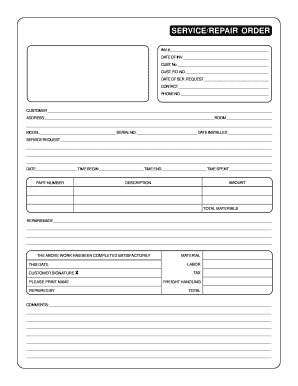

How to complete a 609 and 611 letter

To complete a 609 or 611 letter effectively, follow these steps:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.