Credit Dispute Letter Template Pdf

What is Credit dispute letter template pdf?

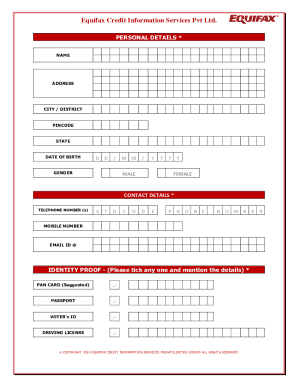

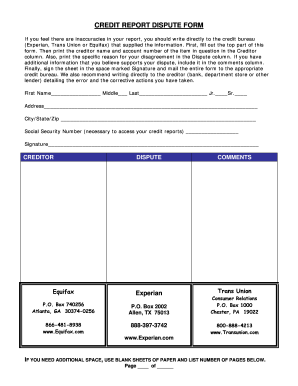

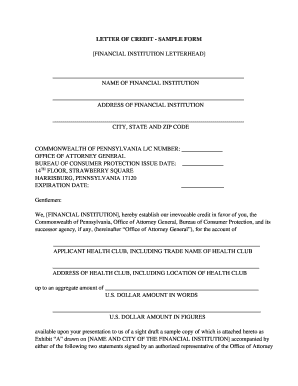

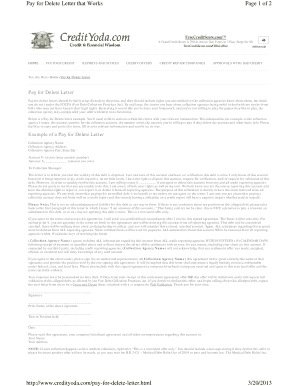

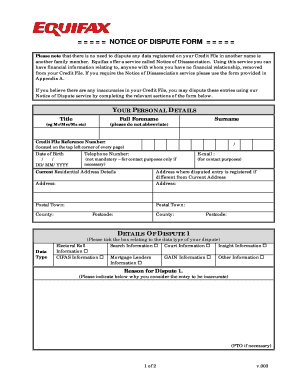

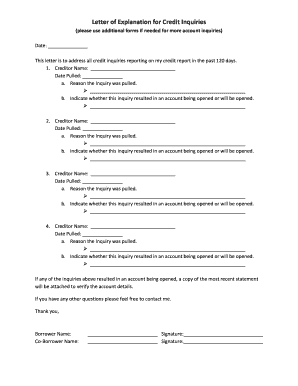

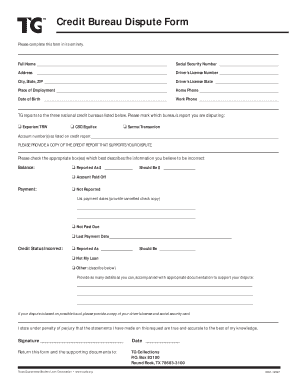

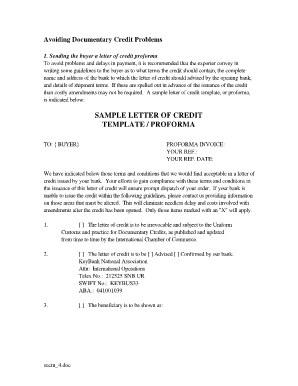

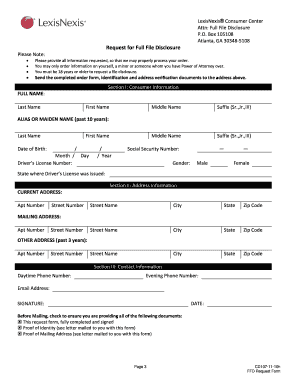

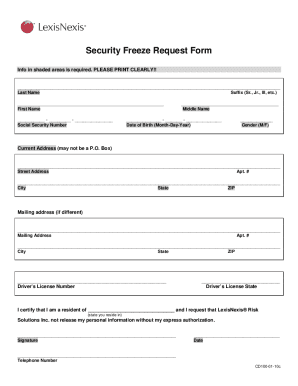

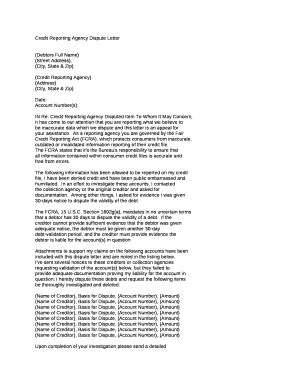

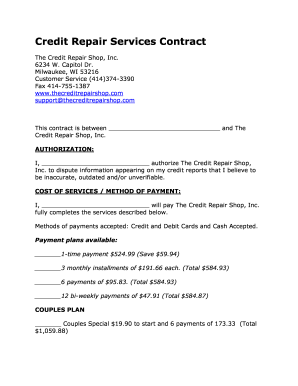

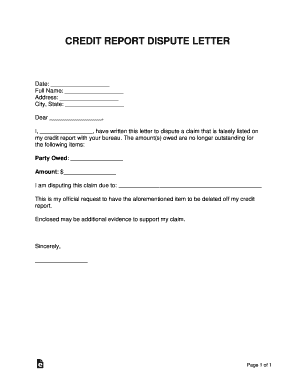

A Credit dispute letter template PDF is a standardized format that individuals can use to dispute inaccurate information on their credit report. This template provides a structured layout for users to communicate with credit bureaus and request corrections to their credit history.

What are the types of Credit dispute letter template pdf?

There are several types of Credit dispute letter templates available in PDF format. Some common types include:

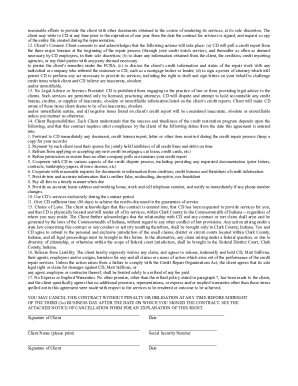

How to complete Credit dispute letter template pdf

Completing a Credit dispute letter template in PDF format is a simple process. Follow these steps to create an effective dispute letter:

pdfFiller empowers users to create, edit, and share documents online, offering unlimited fillable templates and powerful editing tools. With pdfFiller, users have everything they need to get their documents done efficiently and accurately.