Tuition Reimbursement Policy Template

What is Tuition reimbursement policy template?

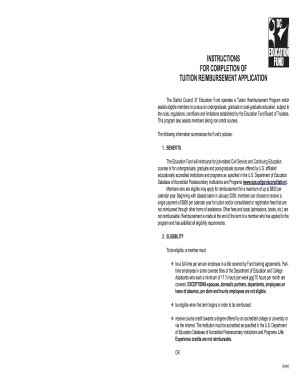

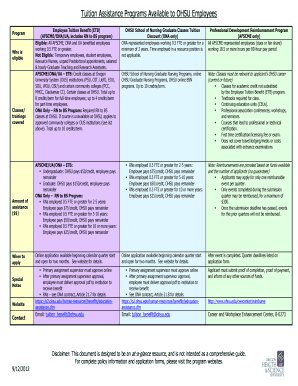

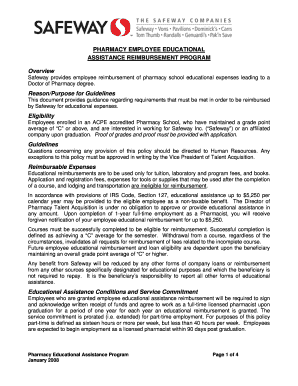

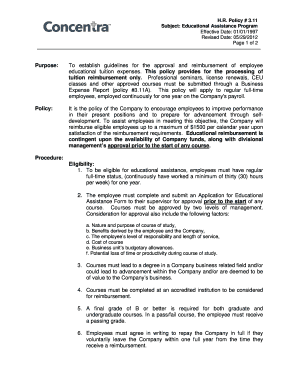

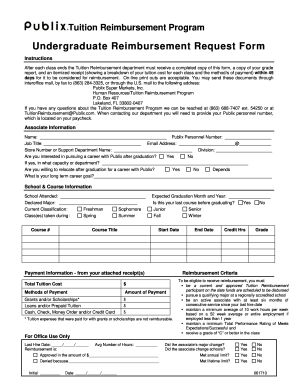

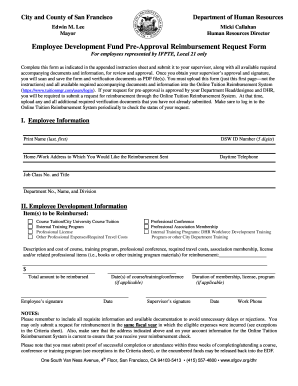

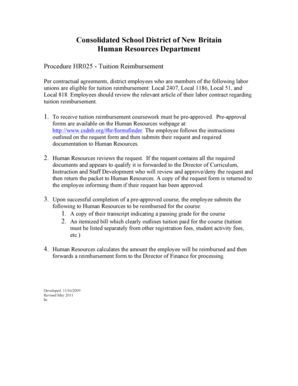

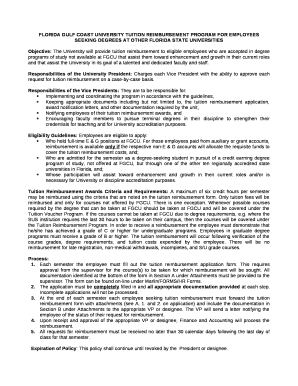

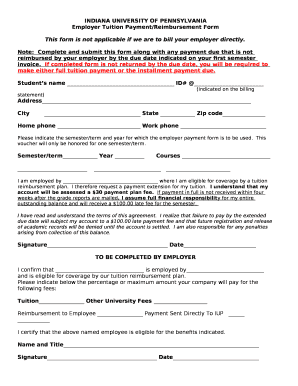

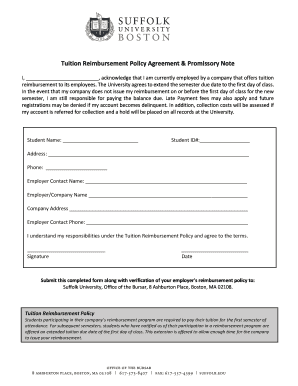

The Tuition reimbursement policy template is a document that outlines the terms and conditions under which an organization will reimburse employees for their tuition expenses. This policy serves as a guide for employees who wish to continue their education while working and seek financial support from their employer.

What are the types of Tuition reimbursement policy template?

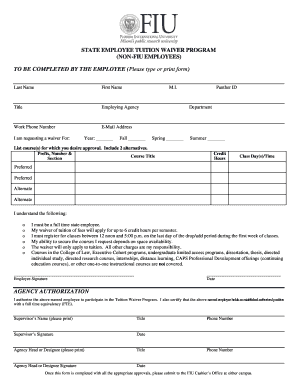

There are several types of Tuition reimbursement policy templates that organizations can use. Some common types include: 1. Standard Tuition Reimbursement Policy Template 2. Student Loan Reimbursement Policy Template 3. Graduate Degree Reimbursement Policy Template 4. Professional Development Reimbursement Policy Template

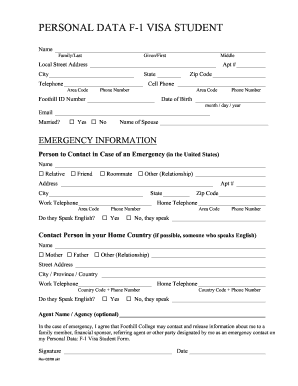

How to complete Tuition reimbursement policy template

Completing a Tuition reimbursement policy template is a straightforward process. You can follow these steps to ensure that your document is properly filled out: 1. Fill in your personal information, including name, employee ID, and contact details. 2. Specify the educational program or course for which you are seeking reimbursement. 3. Provide details on the reimbursement amounts, eligibility criteria, and submission deadlines. 4. Sign and date the document to acknowledge your agreement with the policy terms.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.