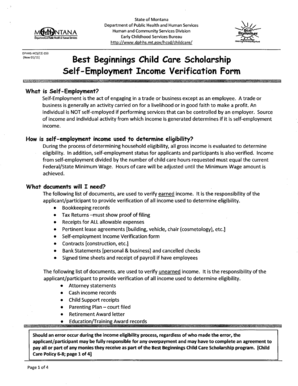

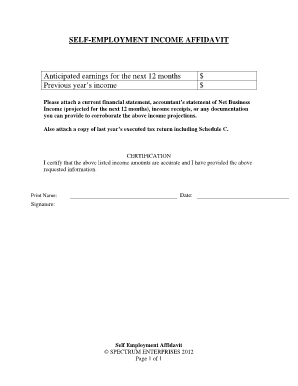

Self-employment Income Verification Form

What is Self-employment income verification form?

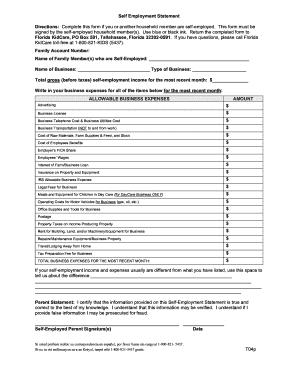

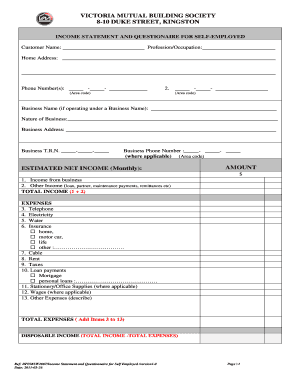

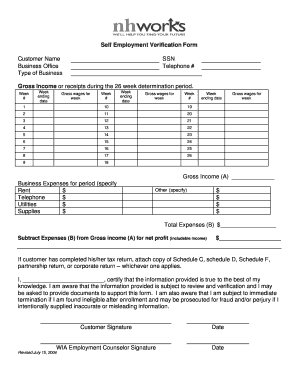

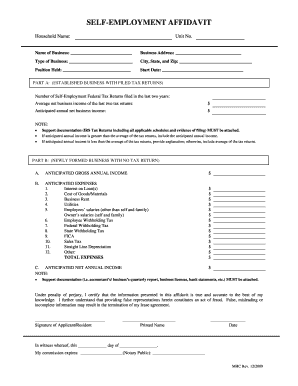

The Self-employment income verification form is a document used to verify the income of individuals who are self-employed. It is often requested by lenders, landlords, or government agencies to ensure that the self-employed individual has a stable income.

What are the types of Self-employment income verification form?

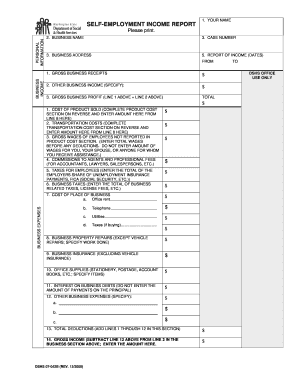

There are several types of Self-employment income verification forms, including:

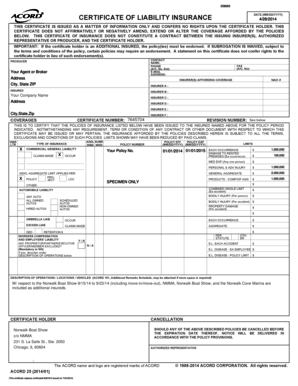

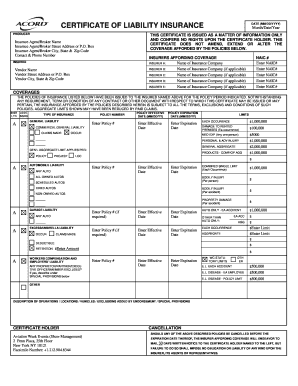

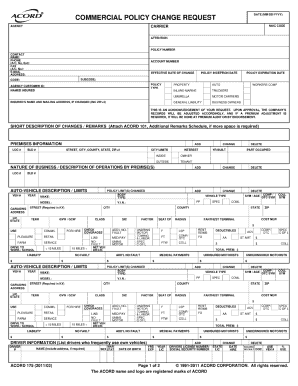

IRS Form 4506-T: This form allows lenders to request a transcript of the self-employed individual's tax return from the IRS.

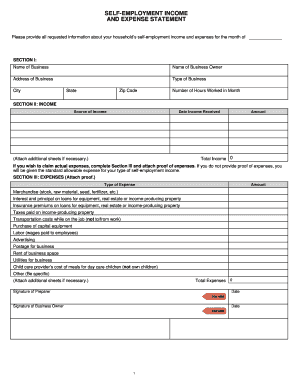

Profit and Loss Statement: This document shows the self-employed individual's income and expenses over a specific period.

Bank Statements: These can be used to show the self-employed individual's income deposits and financial stability.

How to complete Self-employment income verification form

Completing a Self-employment income verification form is crucial to provide accurate proof of income. Here are some steps to help you complete the form:

01

Gather all necessary documents, such as tax returns, profit and loss statements, and bank statements.

02

Fill out the form accurately, ensuring all information is up to date and relevant.

03

Double-check the form for any errors or missing information before submitting it.

04

Keep a copy of the completed form for your records.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Self-employment income verification form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

How do self-employed people verify income for mortgage?

Proof of income Lenders want to see that the amount you earn from self-employment is steady or (ideally) increasing over time. For homebuyers with a traditional job, paystubs and W-2s serve as proof of regular income. But for self-employed individuals, income records could include: Two years of personal tax returns.

What is considered self-employment documentation?

Any accurate, detailed record of your self-employment income and expenses. It can be a spreadsheet, a document from an accounting software program, a handwritten "ledger" book, or anything that records all self-employment income and expenses.

How do I verify my self-employed income?

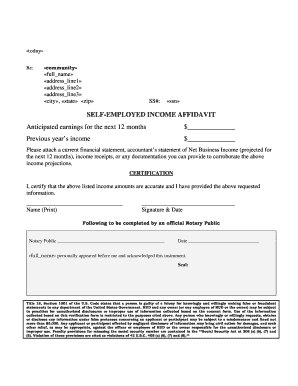

If you're self-employed, you can show proof of income in the following ways: Use a 1099 form from your client showing how much you earned from them. Create a profit and loss statement for your business. Provide bank statements that show money coming into the account. THIS is how to show proof of income when self-employed [2023] stilt.com https://.stilt.com › blog › 2022/02 › how-to-show-p stilt.com https://.stilt.com › blog › 2022/02 › how-to-show-p

Does self-employment count as employment history?

The short answer is yes. You absolutely should. Your self-employment is still a part of your work experience, and you should not omit it. As long as it is relevant, it doesn't matter if it is a full-time job, freelance, or self-employment.

How does IRS verify self-employment?

Posted by Frank Gogol in Taxes | Updated on June 20, 2023 At a Glance: Proof of income for self-employed individuals can be shown through a 1099 form from clients, profit and loss statements, bank statements with regular deposits, previous year's federal tax return, or self-created pay stubs.

How do I write an income verification letter for self-employed?

3 Types of documents that can be used as proof of income Annual tax returns. Your federal tax return is solid proof of what you've made over the course of a year. Bank statements. Your bank statements should show all your incoming payments from clients or sales. Profit and loss statements. What Counts as Proof of Income for Self-Employed People? - Bungalow bungalow.com https://bungalow.com › articles › how-to-show-proof-of- bungalow.com https://bungalow.com › articles › how-to-show-proof-of-