Laws On Garnishment

What is Laws on garnishment?

Laws on garnishment refer to the legal processes that allow creditors to collect debts by taking money directly from a person's paycheck or bank account. These laws are in place to protect the rights of both creditors and debtors in financial disputes.

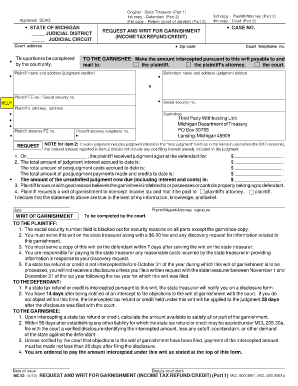

What are the types of Laws on garnishment?

The types of Laws on garnishment can vary depending on the jurisdiction and the type of debt involved. Some common types include:

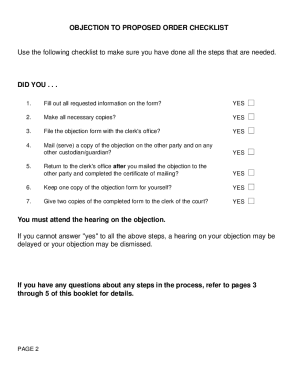

How to complete Laws on garnishment

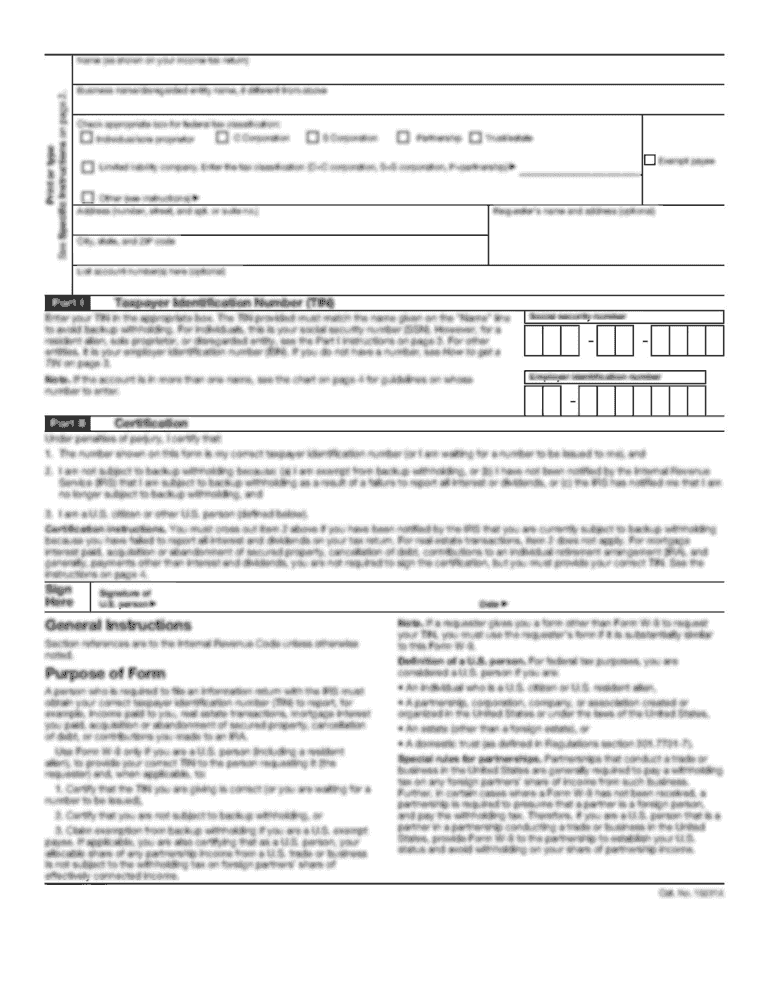

Completing Laws on garnishment can be a complex process, but it is essential to follow the legal requirements to avoid any potential issues. Here are some steps to help you navigate through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.