Garnished Wages Without Notification

What is Garnished wages without notification?

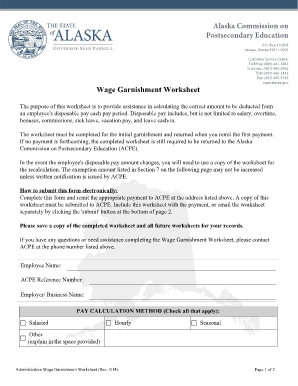

Garnished wages without notification refers to the situation where an employer deducts money from an employee's paycheck to pay off debts without informing the employee beforehand.

What are the types of Garnished wages without notification?

There are two main types of garnished wages without notification:

Involuntary wage garnishment: Employers are legally required to deduct a certain amount from an employee's paycheck to settle debts without informing the employee in advance.

Voluntary wage garnishment: Employees agree to have a specific amount deducted from their paychecks to repay debts without prior notification.

How to complete Garnished wages without notification

To handle garnished wages without notification effectively, follow these steps:

01

Contact your employer: Reach out to your employer to understand why your wages are being garnished without prior notice.

02

Seek legal advice: Consult with an attorney specialized in labor law to explore your rights and options in such situations.

03

Negotiate with creditors: Try to negotiate with creditors to set up a repayment plan that works for both parties.

04

Keep detailed records: Keep records of all communications and transactions related to the garnished wages to protect your rights.

05

Consider using pdfFiller: pdfFiller empowers users to handle legal documents efficiently and securely, providing a wide range of templates and editing tools for document management.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Garnished wages without notification

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

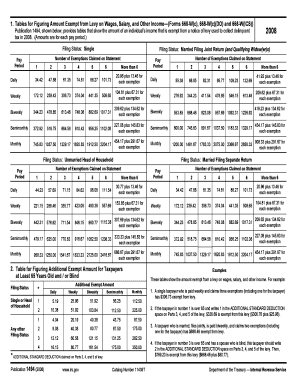

What is the most wages can be garnished?

Federal Wage Garnishment Limits for Judgment Creditors If a judgment creditor is garnishing your wages, federal law provides that it can take no more than: 25% of your disposable income, or. the amount that your income exceeds 30 times the federal minimum wage, whichever is less.

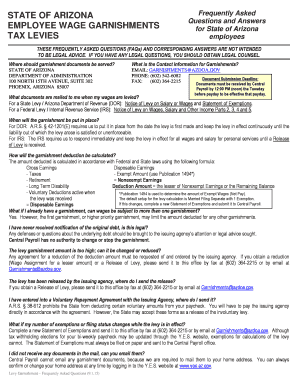

How long do you have to pay the IRS before they garnish your wages?

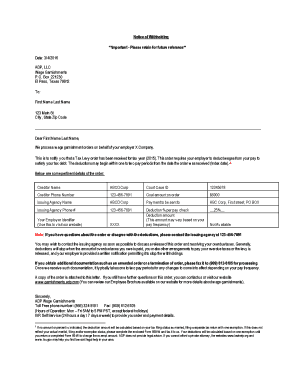

IRS procedures prior to garnishment If you fail to pay this invoice, at some point after you will receive a Final Notice of Intent to Levy and a Notice of Your Right to a Hearing. These last two documents must be sent at least 30 days before the IRS begins to garnish your wages.

Can IRS garnish wages without warning?

Before the IRS takes any collections actions, it must follow procedures to ensure yourcollections due process rights. That means the IRS can't start garnishing your wages without warning to collect back taxes. You'll receive IRS notices stating that you have a balance due.

How likely is the IRS to garnish wages?

However, the IRS doesn't simply jump to garnishing your wages when you don't pay your income tax bill. It is one of the final steps of the tax collection process and the IRS is often willing to work with taxpayers to come up with alternatives to garnishment.

Can IRS garnish without notice?

1. You must receive a written notice in advance. The IRS cannot garnish your wages without giving you ample notice before the garnishment begins.

How can I stop the IRS from garnishing my wages?

1) Pay off your tax debt in full. The first way to stop wage garnishment is to pay your tax debt in full. 2) Set up a payment plan. The IRS is typically willing to work with taxpayers who owe a tax debt. 3) Negotiate an Offer in Compromise. 4) Declare hardship. 5) Declare bankruptcy. 6) Work with a tax professional.