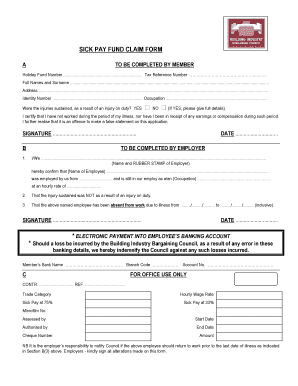

Holiday Pay For Hourly Employees

What is Holiday pay for hourly employees?

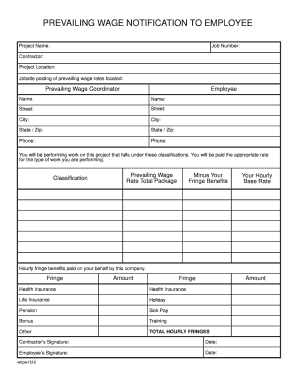

Holiday pay for hourly employees refers to the additional compensation provided to employees who work on designated holidays. This pay is usually higher than the regular hourly rate to compensate for working on a holiday.

What are the types of Holiday pay for hourly employees?

The types of Holiday pay for hourly employees include:

Time and a half pay for hours worked on the holiday

Double pay for hours worked on the holiday

Regular pay with a day off in lieu of working on the holiday

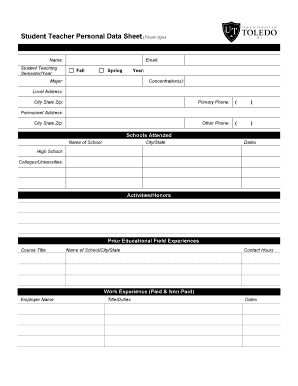

How to complete Holiday pay for hourly employees

To complete Holiday pay for hourly employees, follow these steps:

01

Check your employment contract or company policy for information on holiday pay rates

02

Track your hours worked on holidays to ensure accurate compensation

03

Submit any necessary documentation or timecards to your employer for holiday pay processing

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Holiday pay for hourly employees

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

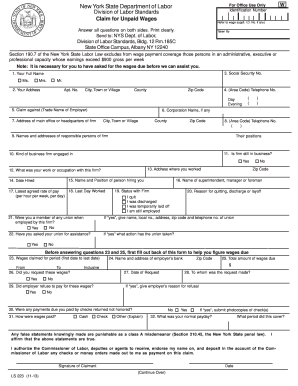

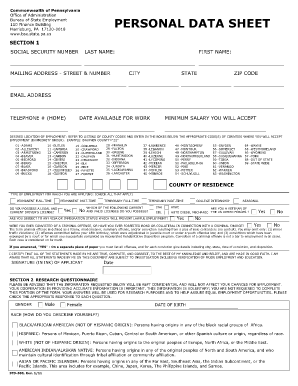

What is the law about holiday pay in Florida?

Neither federal nor Florida law requires employees who work on a holiday to be paid time and a half just because it is a holiday. Holidays are considered the same as any other work day. The law only requires an employer to pay the employee for hours worked on the holiday.

What happens when a holiday falls on your day off?

If a holiday falls on one of the employee's regular nonworkdays other than a Sunday, the employee's workday immediately before that regular nonworkday is the legal holiday. If a designated holiday falls on a Sunday (nonworkday), the employee's next workday is the legal holiday.

Do a company have to pay out floating holidays in California?

For example, in California, if floating holidays can be taken at any time, they are considered vacation days. That means they're essentially the same as earned wages, meaning employees are entitled to payment for them upon termination.

What is considered holiday pay in California?

As in most other states across the country, California employers do not have to pay their employees any extra money just because they work on official holidays. If an employee works on a holiday, they will be paid their usual rate of pay.

Do hourly employees get paid holidays NYC?

New York law does not require private employers to provide employees with either paid or unpaid holiday leave. In New York, a private employer can require an employee to work holidays.

Does California require holiday pay?

No, there is no state law or federal employment law that requires employers in California to provide holiday pay or to give you time off during a holiday. However, many employers provide extra holiday pay or paid time off, anyway.