Company Vehicle Policy Nz

What is Company vehicle policy nz?

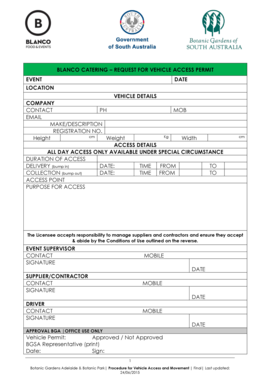

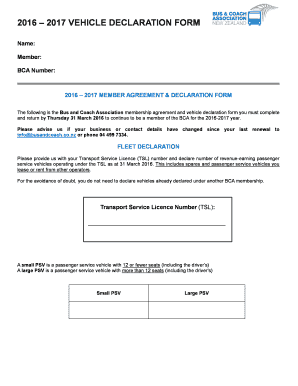

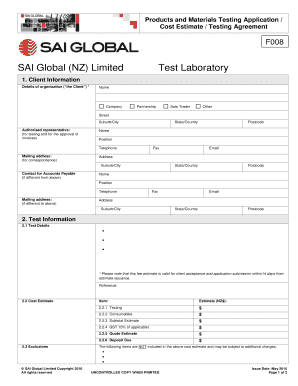

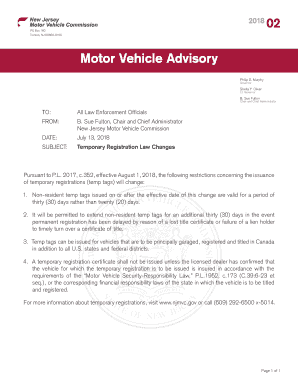

The Company vehicle policy in New Zealand is a set of guidelines and regulations regarding the use of company vehicles by employees. This policy outlines the rules for driving company vehicles, maintenance responsibilities, insurance requirements, and reporting procedures.

What are the types of Company vehicle policy nz?

There are several types of Company vehicle policies in New Zealand, including:

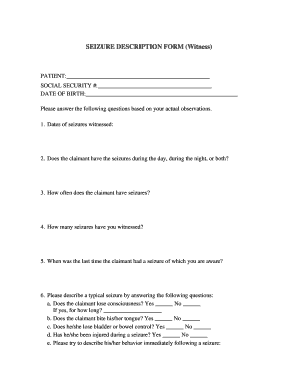

Driver eligibility criteria

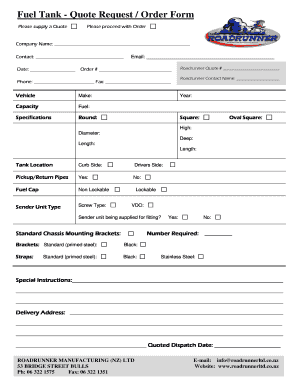

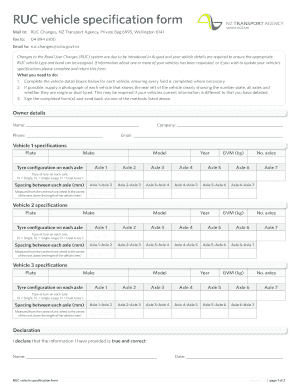

Vehicle maintenance guidelines

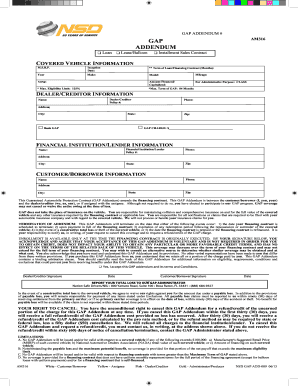

Insurance coverage requirements

Accident reporting procedures

How to complete Company vehicle policy nz

Completing the Company vehicle policy in New Zealand is a straightforward process that involves the following steps:

01

Read and familiarize yourself with the policy guidelines

02

Provide all required information, such as driver's license and insurance details

03

Sign and date the policy document to acknowledge your understanding and agreement

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Company vehicle policy nz

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

What is a company vehicle worth in salary NZ?

To reflect the car as part of the remuneration package, 'personal use value' is incorporated. This can range from 100 to 25 percent of the annualised cost of the car, depending on the nature of the work performed, the level of branding, the level of personal use, and how the organisation values cars.

How do you calculate the value of a company car?

With the cents-per-mile method, fair market value of the employee's personal usage of the vehicle is determined simply by multiplying the number of personal miles driven by the IRS Standard Mileage Rate (65.5 cents for 2023). This rate includes the cost of maintenance, insurance, and fuel.

Is a company car worth it for employee?

Companies often provide vehicles for their employees. Company cars reap several benefits, including access to transportation and low-cost branding and advertising. But with those benefits come trade-offs, including regular maintenance costs, increased liability and high upfront investment.

How much is a company vehicle worth annually?

However, there is no rule of thumb when it comes to the value of a car. It typically depends on what kind of car your company leases on your behalf. If the standard car for an employee is a mid-sized American car then the value of the car can range from $10K to $18K.

How much value does a company vehicle add to your salary?

On average, a company car is worth $8,500 a year. This figure is with the assumption that the employee does not have to pay any expenses for any fuel, insurance, repair, or maintenance. If an employee is responsible for any of those expenses, they should deduct that cost from the original figure.

What is the company car allowance policy?

Car allowance reimburses employees' costs for using their personal vehicle for work-related purposes. These expenses include fuel, maintenance, and other costs of operating a vehicle. The payment will differ depending on your business - the type of travel your business requires and how the refund is set up.