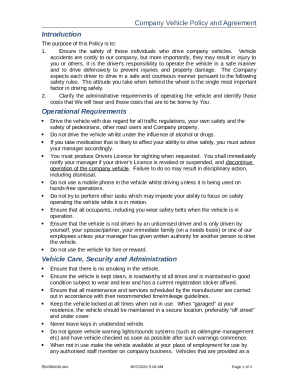

Personal Use Of Company Vehicle

What is Personal use of company vehicle?

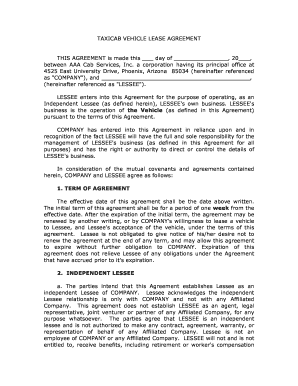

Personal use of a company vehicle refers to the situation in which an employee is allowed to use a company-owned vehicle for non-work-related activities. This can include commuting to and from work, running personal errands, and using the vehicle for recreational purposes.

What are the types of Personal use of company vehicle?

The types of personal use of a company vehicle can vary depending on the company's policies. Some common types include:

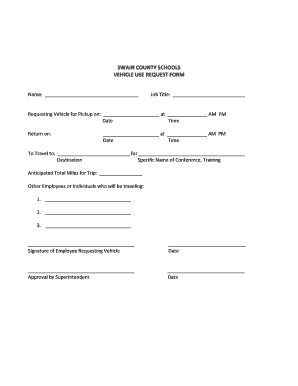

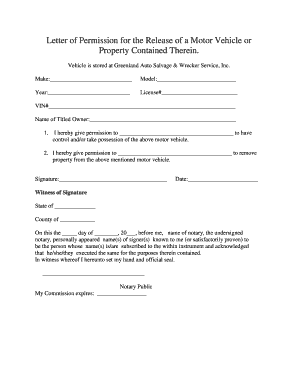

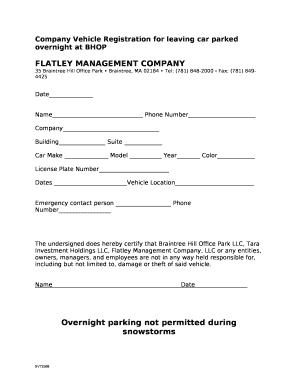

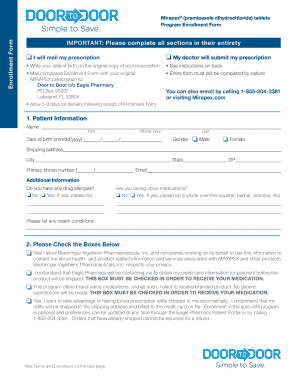

How to complete Personal use of company vehicle

Completing the personal use of a company vehicle form is essential to ensure compliance with company policies and IRS regulations. Here are the steps to complete this process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.