Ffcra Leave Request Form

What is Ffcra leave request form?

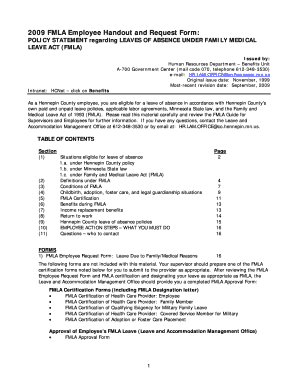

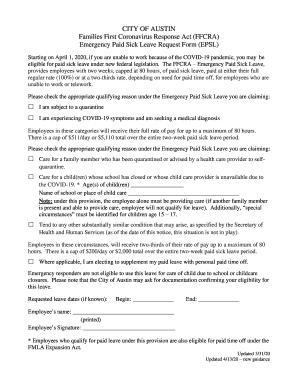

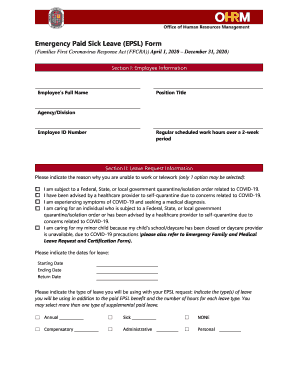

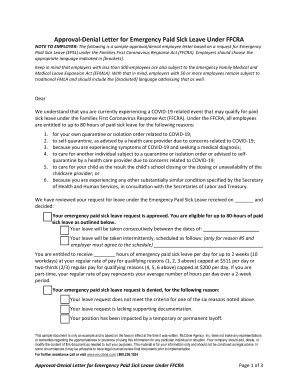

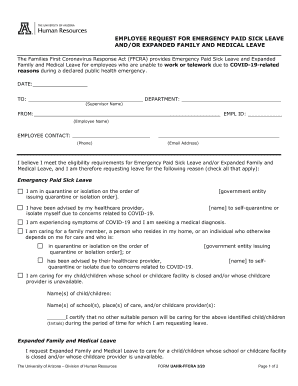

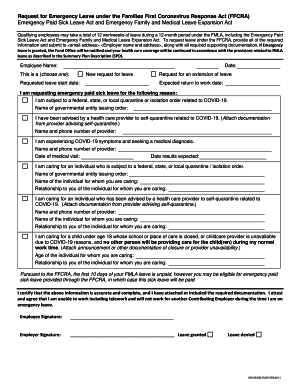

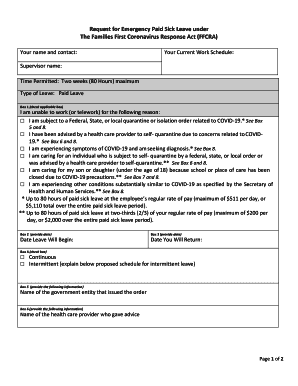

The FFCRA leave request form is a document that employees can use to request leave under the Family First Coronavirus Response Act (FFCRA). This form allows employees to request time off for qualifying reasons related to COVID-19.

What are the types of Ffcra leave request form?

There are two main types of FFCRA leave request forms: the Emergency Paid Sick Leave Act (EPSLA) form and the Emergency Family and Medical Leave Expansion Act (EFMLEA) form.

Emergency Paid Sick Leave Act (EPSLA) form

Emergency Family and Medical Leave Expansion Act (EFMLEA) form

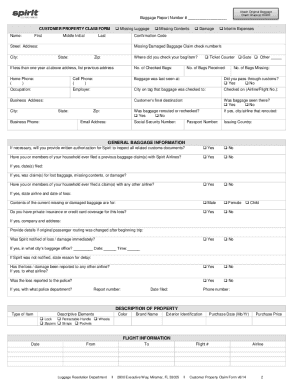

How to complete Ffcra leave request form

To complete the FFCRA leave request form, follow these steps:

01

Fill in your personal information, including name, employee ID, and contact details.

02

Indicate the type of leave you are requesting (EPSLA or EFMLEA).

03

Provide the reason for your leave request and any supporting documentation if required.

04

Submit the form to your employer for review and approval.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Who is eligible for COVID pay in California?

A covered employee is eligible for COVID-19 Supplemental Paid Sick Leave if the employee is caring for a family member whom a medical professional has recommended to stay home due to COVID-19. or caring for a family member who is subject to a COVID-19 related quarantine or isolation period as defined by an order or

What is the status of Ffcra?

The requirement that employers provide paid sick leave and expanded family and medical leave under the Families First Coronavirus Response Act (FFCRA) expired on Dec. 31, 2020.

How is Ffcra calculated?

Calculating the Regular Rate under the FFCRA An employer can compute the Regular Rate for each employee by adding all compensation that is part of the regular rate over the applicable period (the lesser of six months or their period of employment) and dividing that sum by all hours actually worked in the same period.

Do you get paid for unused sick days in Washington state?

How much paid sick leave do I get? At least 1 hour for every 40 hours worked. This includes part-time and seasonal workers. You may carry over up to 40 hours of unused leave into the next year.

Is FFCRA and cares act the same?

While the tax credit under the FFCRA relates to wages (and related health care costs) for employees on mandatory paid leave due to COVID-19, the tax credit under the CARES Act relates to wages (and related health care costs) paid to employees when the employer has fully or partially suspended its business operations,

Is the IRS giving sick leave credits for COVID?

The FFCRA provides businesses with tax credits to cover certain costs of providing employees with paid sick leave and expanded family and medical leave for reasons related to COVID-19, for periods of leave from April 1, 2020, through March 31, 2021.