Paycheck Direct Deposit Form

What is Paycheck direct deposit form?

A Paycheck direct deposit form is a document that an employee uses to authorize their employer to deposit their salary directly into their bank account instead of receiving a physical check. This convenient method saves time and ensures prompt payment on payday.

What are the types of Paycheck direct deposit form?

There are two main types of Paycheck direct deposit forms: Standard direct deposit form and Custom direct deposit form.

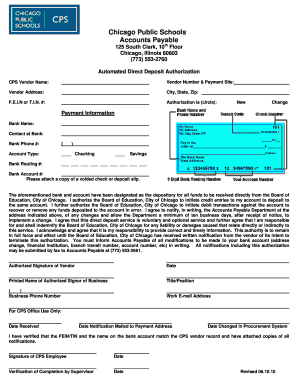

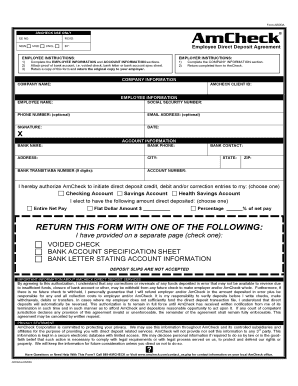

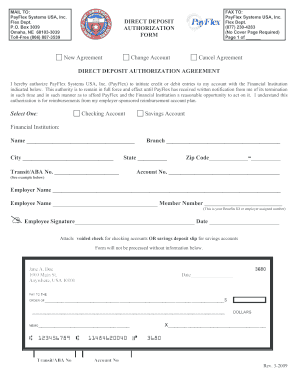

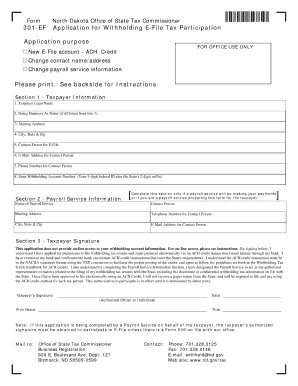

Standard direct deposit form: This form is provided by the employer and typically requires the employee to fill in their bank account information, including the account number and routing number.

Custom direct deposit form: Some businesses may have their customized direct deposit form that includes additional fields for specific information or authorization requirements.

How to complete Paycheck direct deposit form

Completing a Paycheck direct deposit form is easy and straightforward. Here are the steps you need to follow:

01

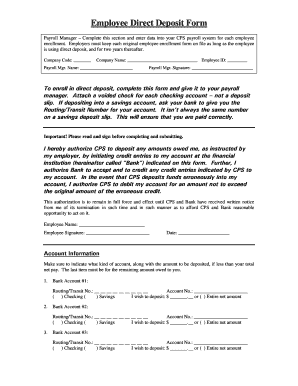

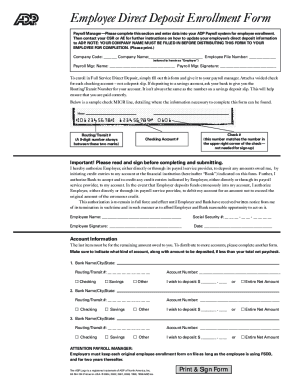

Gather your bank account information, including the bank name, account number, and routing number.

02

Fill in your personal information, such as your name, address, and social security number.

03

Sign and date the form to authorize your employer to deposit your paycheck directly into your bank account.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Paycheck direct deposit form

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I fill out a direct deposit form online?

With a tool like PDFChef from Movavi, you can easily fill out your direct deposit info for your employer, so you can start receiving your pay directly to your account – with no need to go to the bank to deposit your funds.

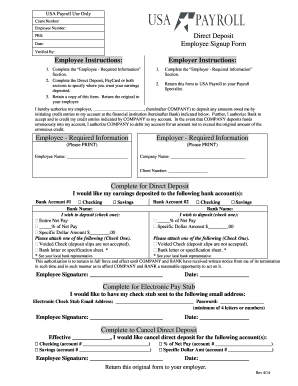

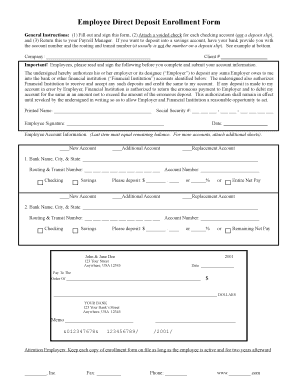

What paperwork is needed for direct deposit?

Each employee needs to provide the following information: bank name, account type, account number and routing number. Some states also require employees to sign a consent form before their employer can switch them to direct deposit.

How do I submit a direct deposit form?

Submit your completed form to your employer, their payroll company, or their HR department. You may need to scan your printed copy, or they may ask you to mail it or deliver it in person. Or you may be able to submit the form by email. This will depend on your employer's preferences.

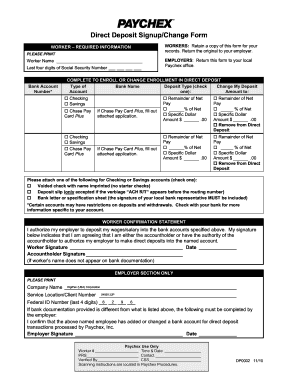

What is Paychex direct deposit form?

The Paychex direct deposit form must be filled out and signed by an employee wishing to set up a direct deposit transfer as a method of compensation with their employer. This form should then be submitted by the employer to the Paychex office where they hold a payroll account.

Do I need a voided check for direct deposit?

No. You do not need a voided check to set up direct deposit. If you're reordering checks, setting up a direct deposit or an automatic payment or preparing a wire transfer, you'll probably be asked to provide an ABA routing number. This sample check image shows where ABA routing numbers can be found on your checks.

What form do I need for direct deposit?

A direct deposit authorization form authorizes a third party, usually an employer for payroll, to send money to a bank account. Typically, an employer requesting authorization will require a voided check to ensure that the account is valid.